Why are automakers trying to kill AM/FM radio? [Fred Jacobs]

Top broadcast radio consultant Fred Jacobs dissects his experience with the auto industry and what it means for the future of radio.

by Fred Jacobs of Jacobs Media

I can’t tell you how long my love affair with cars has lasted. When you’re born and raised in Detroit, cars are in your DNA. My best memories include GTOs, Bel Airs, Road Runners, and a soundtrack of the Beach Boys, Motown, and Mitch Ryder on AM radio that perfectly accompanied all that Motor City metal.

Dad took us to Cobo Hall every frigid January for the Detroit Auto Show, the annual celebration of the city’s #1 export – the car. It’s no wonder then that when Paul and I first went to CES back in 2009, we gravitated to the North Hall of the Las Vegas Convention Center where “this year’s models” were on display. We got to meet many automotive experts who welcomed a couple of Detroit radio natives with open arms.

But the storm clouds were already gathering on the horizon. Despite being partners in the dashboard for most of a century, the relationship between radio and automotive wasn’t contentious or even frosty. It just didn’t exist. Even though consumers instinctively connected radio to cars, neither industry had a whole lot to do with the other. The auto companies dutifully installed AM/FM receivers in their dashboards, and the radio industry gladly monetized the hell out of them.

It wasn’t until February 2013 when we all witnessed the first signs of the strain at a Radio Ink “Convergence” conference. It came during a panel moderated by Buzz Knight that included Valerie Shuman (Connected Vehicle Trade Association), Frankie James (General Motors), and Thilo Koslowski (then with Gartner).

The session was going along smoothly, until Buzz began to wrap it up, asking his panelists for their final thoughts. And Thilo threw out the grenade suggesting that AM/FM radios might not be standard equipment in new cars, perhaps by 2025 or possibly as early as 2020. Frankie added that in Europe, some automakers were already manufacturing vehicles without over the air radios installed.

Radio Ink publisher Eric Rhoads heard enough, jumped on stage brandishing a microphone, and demanded more information from his panel of experts. Thilo calmed the situation a bit, but Eric was sufficiently agitated at that point. And justifiably so. The next day he wrote, “A Cold Harsh Reality for Radio: AM/FM Will be removed from The Dash.”

The die was cast. Later than year, we partnered with Eric and Radio Ink, along with Valerie Shuman, for the first of three DASH Conferences in Detroit. They were designed to bridge the differences between radio and car execs, seeking out areas of shared opportunity and collaboration.

A few years later, the NAB launched its car committee, and Paul and I felt like we had accomplished something meaningful. But things never really progressed a whole lot as far as close relations with the auto industry were concerned. During that time, I remember hearing radio executives talk about the goal of letting automakers know our priorities as it pertained to how radio looked in car dashboards.

Paul and I both felt this thinking fell somewhere between delusional and arrogant. And in recent years, we’ve watched the OEMs – the auto manufacturers – coalesce around both Apple CarPlay and Android Auto. Prior to these two tech giants taking over car dashboards, each automaker offered their own proprietary infotainment solution. No two systems were alike, and none was especially good. So it was no surprise when they eventually acquiesced around Apple and Google.

But in just the past few months, we’re seeing what looks to be a different trend. More than ever before, the OEMs are operating independently of one another, making decisions that apparently impact each company’s unique interests rather than falling in lock step with an industry trend.

First, EV makers, starting with Tesla, began eliminating AM radio from their dashboard systems. And recently, Ford announced it would not include AM in any of its new models, a bold departure from other automakers like Stelllantis (which includes Chrysler Jeep) and Hyundai who vow to continue the century-old tradition of making AM radio standard in all their vehicles.

One of my go-to experts in the automotive field the past dozen years or so has been Roger Lanctot, the Director of Automotive Connected Mobility for Techinsights. Roger has earned his nickname – “the most connect person in the connected car space.” He travels the world, he knows everybody in automotive, and he is always looking around the next corner.

Based in the D.C. area, Roger is a radio fan (lots of TSL on WTOP and WAMU), and we’ve co-presented at NAB events over the years.

Last week, Roger attended Radiodays Europe in Prague, and flew home thinking long and hard about automakers and where radio stands in the changing dash. He published an article in LinkedIn over the weekend – “Cars: Radio OUT! TV IN”

Yes, Roger is quoting Jerry Del Colliano, serial naysayer now predicting that FM radio’s days are numbered in the dash, at least as a free feature. Roger points out that Jerry’s prediction, while dire, “is difficult to dismiss.”

He also notes SiriusXM has been paying the auto manufacturers in exchange for their dashboard real estate. Roger foresees a world where an app like TuneIn will provide all the “radio” a driver will ever need.

All this comes back to the evolving reality that each individual OEM will cut its own deals and make their own calls. And like so many other happenings in the media/tech world, things are moving fast.

Over the weekend, GM announced they’re dropping Apple CarPlay from their EVs. These vehicles will still be equipped with Android Automotive – at least for now. And as Roger posits, if these OEMs can dump Apple, “dropping AM/FM radio may no longer seem so far-fetched.”

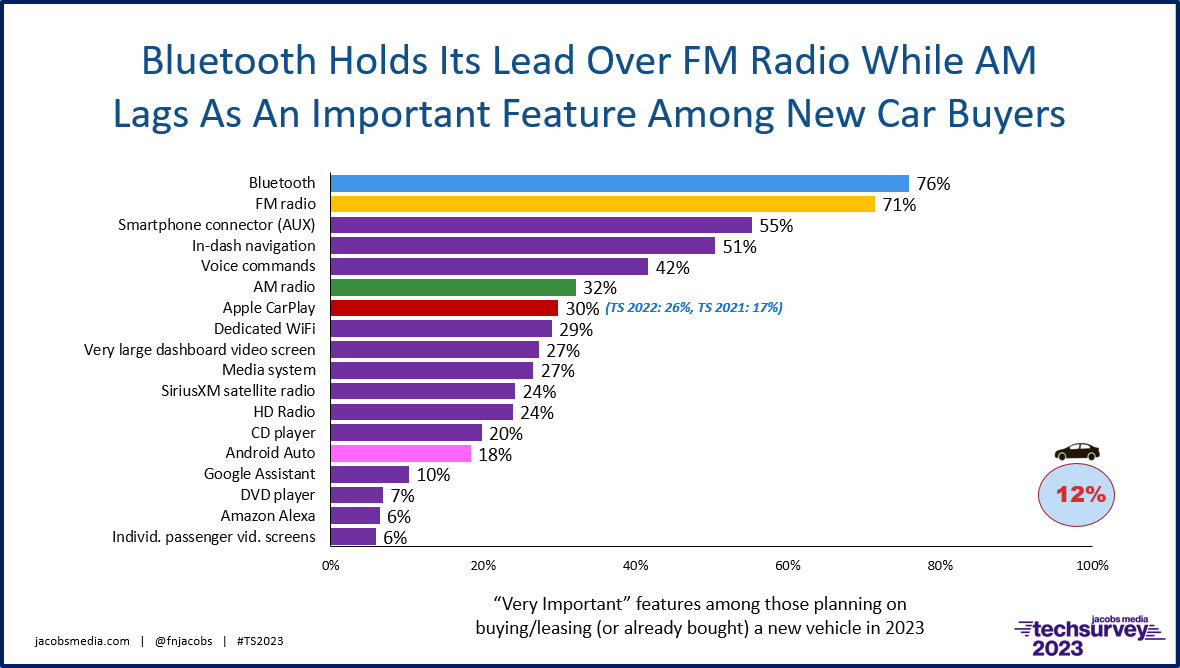

GM’s move cannot be research-based because CarPlay is considerably more popular than Google’s in-dash equivalent. (In fact, you have to wonder whether the car companies are querying their audience at all these days or just running their spreadsheets.) Below is another sneak peek from our new 2023 Techsurvey. Overall, 12% of our respondents look to have a new vehicle in their driveways before the year is out. We ask them about the infotainment-type features they deem “most important.”

There’s a lot to unpack here. But clearly three in ten (30%) point to Apple CarPlay as a highly desirable new car feature, compared to fewer than one-fifth (18%) for Android Auto. And as the inset data show, CarPlay’s popularity is growing, up from 17% just two years ago. Still, GM has decided to base its EV future on Google’s ecosystem.

As was the case in last year’s Techsurvey, Bluetooth edges out FM. a telling stat, especially given that our sample is comprised mostly of core radio fans. Still, FM is mentioned as a very important feature among more than seven in ten (71%) of these new car buyers.

AM, however, lags well behind, mentioned by only about one-third (32%). It’s not a strong showing among those still actively listening to radio, adding to the speculation AM’s days in the dash may be numbered.

Radio broadcasters are now scrambling to drum up support. A story in Axios/Chicagoyesterday covered area stations pushing back against Ford’s decision to go AM-less. Like other major markets, Chicago has a rich tradition of AM radio, including WLS and WGN, call letters that still resonate today.

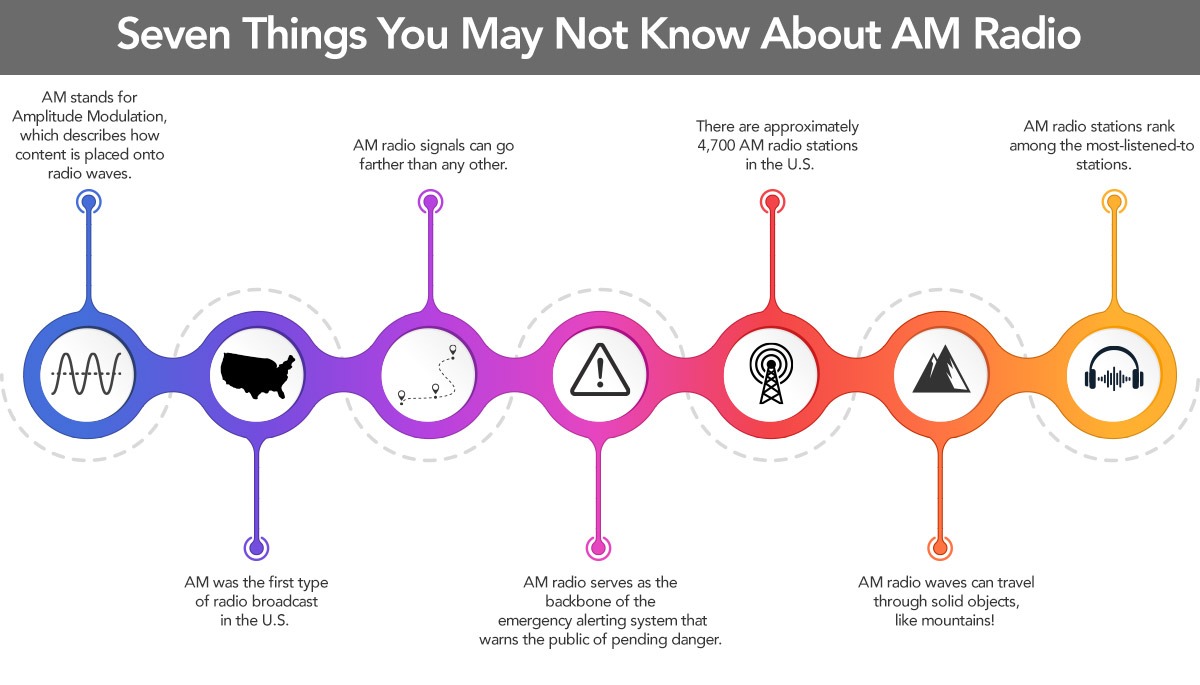

And now, the NAB is stepping up with a new radio campaign, “Depend on AM Radio.” There’s a website, a call to action, and other tools stations can utilize to help make AM’s case.

A little too late? Clearly, automakers will do what they’re going to do – that we know. Whether broadcasters and politicians can bring pressure to bear on the OEMs remains to be seen.

Roger Lanctot offered up an additional observation while in Prague. He met with the Xperifolks and got a look at their near-real time data that comes right off of cars equipped with their DTS AutoStage system.

As we know, in-car listening data has been virtually non-existent. Nielsen’s PPM ratings don’t even show us the overall percentage of radio consumption in the car.

Xperi’s data maven, Desmond Fuller, shared the “heat map” below. It represents actual listening in millions of vehicles equipped with DTS AutoStage over the last seven days. The data determines where drivers are listening to AM – the darker the blue, the more listening is occurring. Maybe those Chicago broadcasters have a point.

Desmond also told me that over the past 30 days, 1,455 unique AM stations have been listened to in DTS Auto-Stage equipped vehicles in the U.S. So much for the argument, “No one listens to AM radio.”

After he saw this data, Roger Lanctot openly wondered why this data isn’t being shared with automakers, analysts, and news media. And thinking down the road, it might not be a bad idea to start making the case for FM in cars. Our four-wheeled friends are experiencing a disruptive period, and broadcast radio should not be left on the sidelines. Making sure the OEMs aren’t just making decisions based on anecdotal information or even focus groups is of paramount importance.

In this crazy first quarter of 2023, the radio industry has been mesmerized by Chat bot AI technology. It’s fascinating, of course, but it is also something of a distraction. While it may not be as techie or sexy, the fate of AM radio in cars may prove to be an even bigger story this year.

Radio broadcasters have had a lot on their plates these past couple decades. But no pressing issue may be bigger than the fate of radio in automotive dashboards.

It looks like there will be a lot to talk about in Vegas.

Note: The NAB has also put together this infographic available here:

The Xperi team will be displaying at the NAB, a good chance to see DTS AutoStage up close.

I’ll be hosting a panel, “Driving Revenue and Insights with Connected Car Listening Data,” Sunday morning, April 16, featuring Xperi’s Joe D’Angelo. More info here.