How EDM Festivals in Asia are reshaping the genre globally

In traditionally Pop-hungry and social media-savvy Asian markets, EDM music festivals in Asia are introducing new sounds to local audiences and influencing global genre trends.

Sheila Lim from the Chartmetric Blog

With the pandemic receding, globally-renowned EDM festivals like Ultra and Electric Daisy Carnival (EDC) have made their long-awaited return to Asia. Last year, the International Music Summit 2022 postulated the valuation of the electronic music industry to be an estimated $6B, and with Asia bearing more than 60 percent of the world’s population, global festival brands continue to eye the region.

Over the past two years, the diverse sounds of EDM have evolved with the rising popularity of darker subgenres, and the pandemic refreshed creativity in electronic music, with emerging artists exploring new ways to incorporate experimental beats. In fact, the most recent Beatport best-selling charts revealed that Tech House holds fast as the most sought-after genre and continues to reign supreme in sales and streams.

As these global festivals bring some of the world’s top electronic music DJs to the main stages, the big bet is on additional acts representing a diversity of EDM genres, including Tech House and Techno artists like Adam Beyer, John Summit, and Chico Rose. But how does the expansion of these festivals move the needle when it comes to the growth of EDM subgenres within a region that largely gravitates toward mainstream Pop music?

Asia’s Appetite for Pop

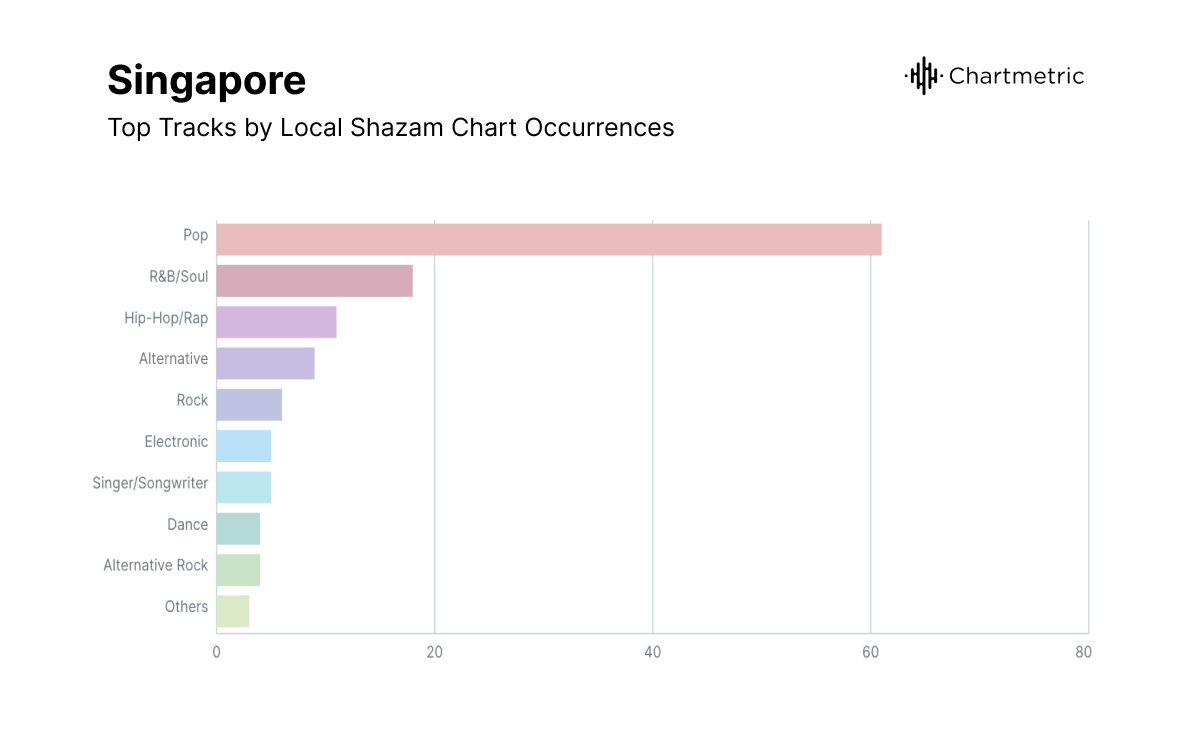

As we described in our Trigger Cities analysis, Asia’s voracious appetite for Pop music provides massive hype potential for Dance Pop, and when it comes to EDM, it’s no surprise that artists who lean toward singable Dance Pop often top the list of fan favorites.

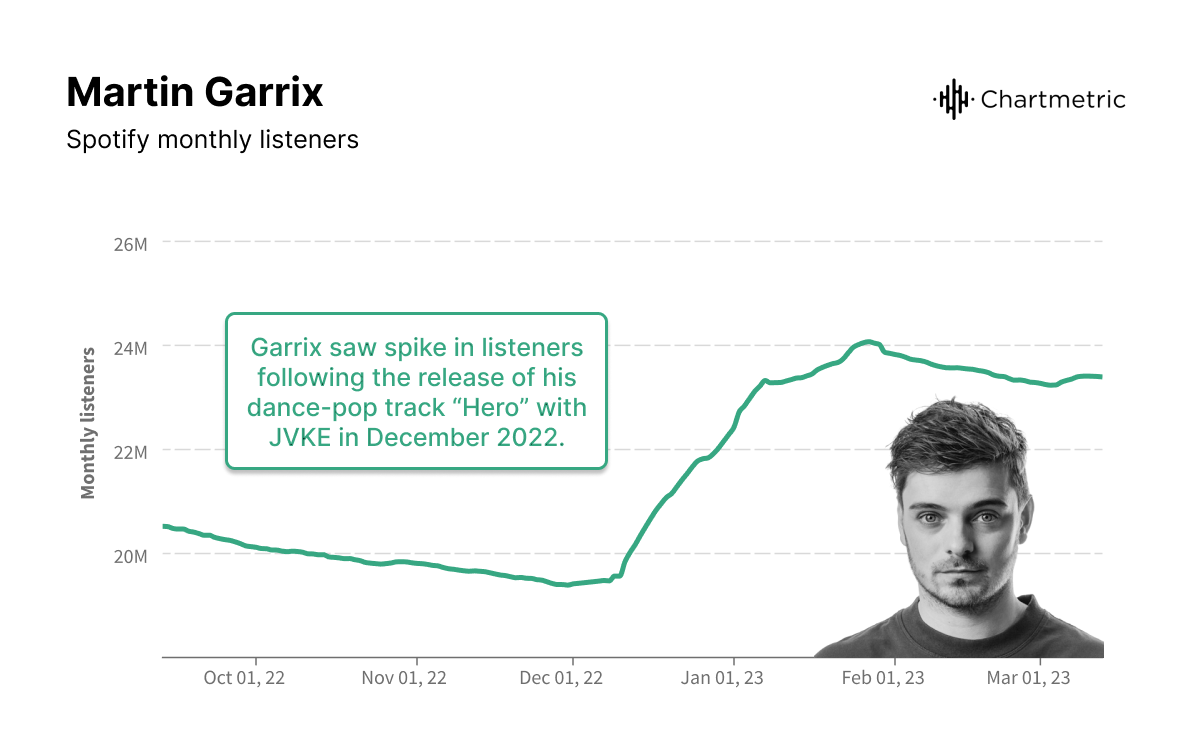

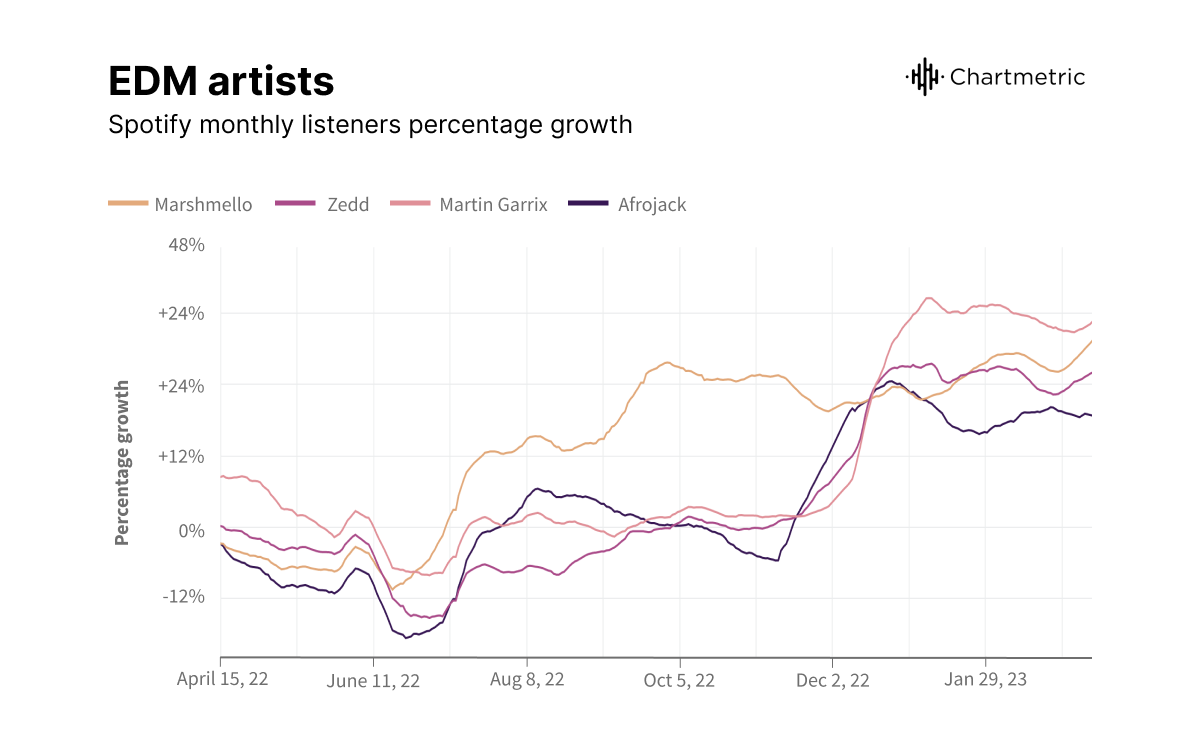

Unsurprisingly, Dance music heavyweights like Martin Garrix, Zedd, Afrojack, and Marshmello are regular marquee headliners at music festivals in Asia. From an organizer’s perspective, the priority lies in ticket sales, so it makes sense to cater to local tastes by booking these commercially successful Dance Pop artists.

In contrast to Dance Pop, Tech House and Techno lean into sparse arrangements of percussive groove and focus on repetitive, hypnotic rhythms. Often incorporating minimal lyrics and featuring a longer, more unconventional sound, these genres are associated with underground clubs and dance scenes, rather than mainstream radio stations.

Music popularity is largely driven by radio airplay in Asia, which leaves Tech House and Techno in the backseat. The lack of commercial appeal and a quality fit with the target demographic results in hesitance to program such genres on mainstream radio. This limits the potential for tastemakers to advocate for new music outside of the typical Dance Pop hits, which undermines the ability of artists like John Summit and Chico Rose to reach audiences in Asia. Nonetheless, there are signs that they’re starting to break through.

Tech House Stars on the Rise in Asia

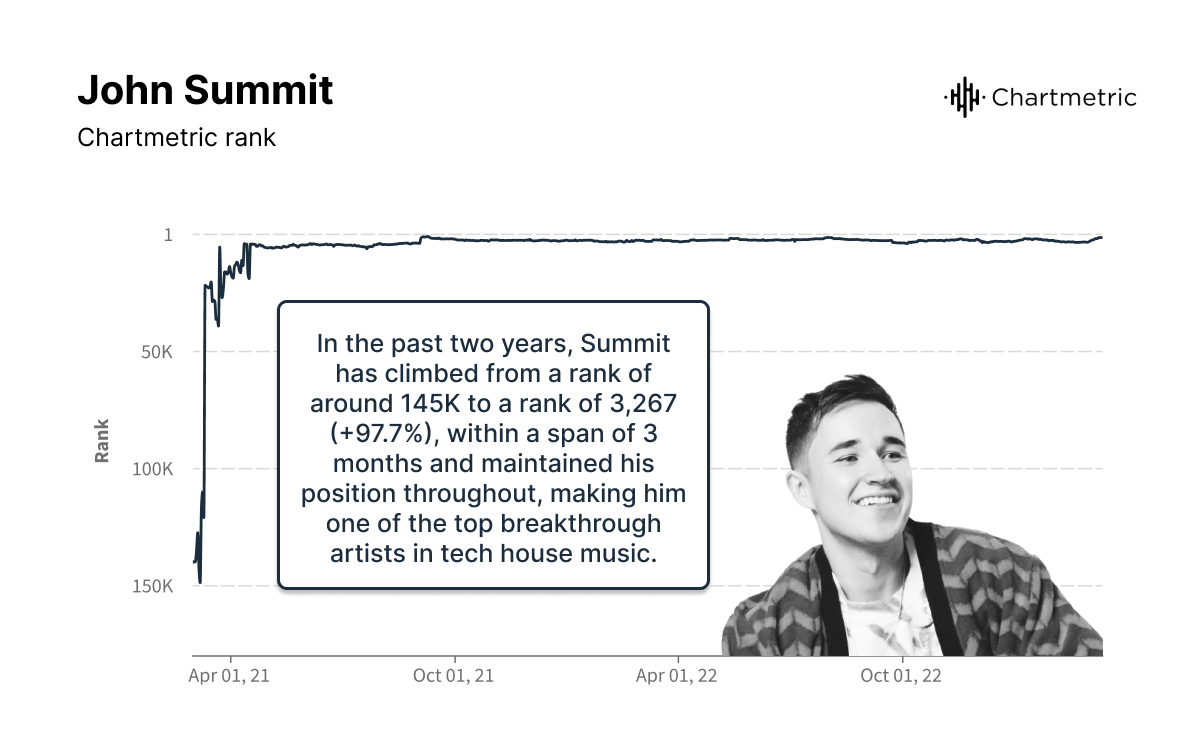

As one of 2022’s most prolific artists, John Summit has quickly become an influential Tech House producer. The Chicago native has become a steady addition to major festival lineups around the world, including EDC Las Vegas, Tomorrowland, and Lollapalooza.

In the last year, his Spotify monthly listeners peaked at an all-time high of 5.9M, and he ruled the Beatport’s Best Selling and Most-Streamed Artists lists. His exhilarating ascension made it timely for his Asian debut at Ultra Beach Bali, where he was added as a headliner to a bill that included Afrojack, Alesso, and KSHMR.

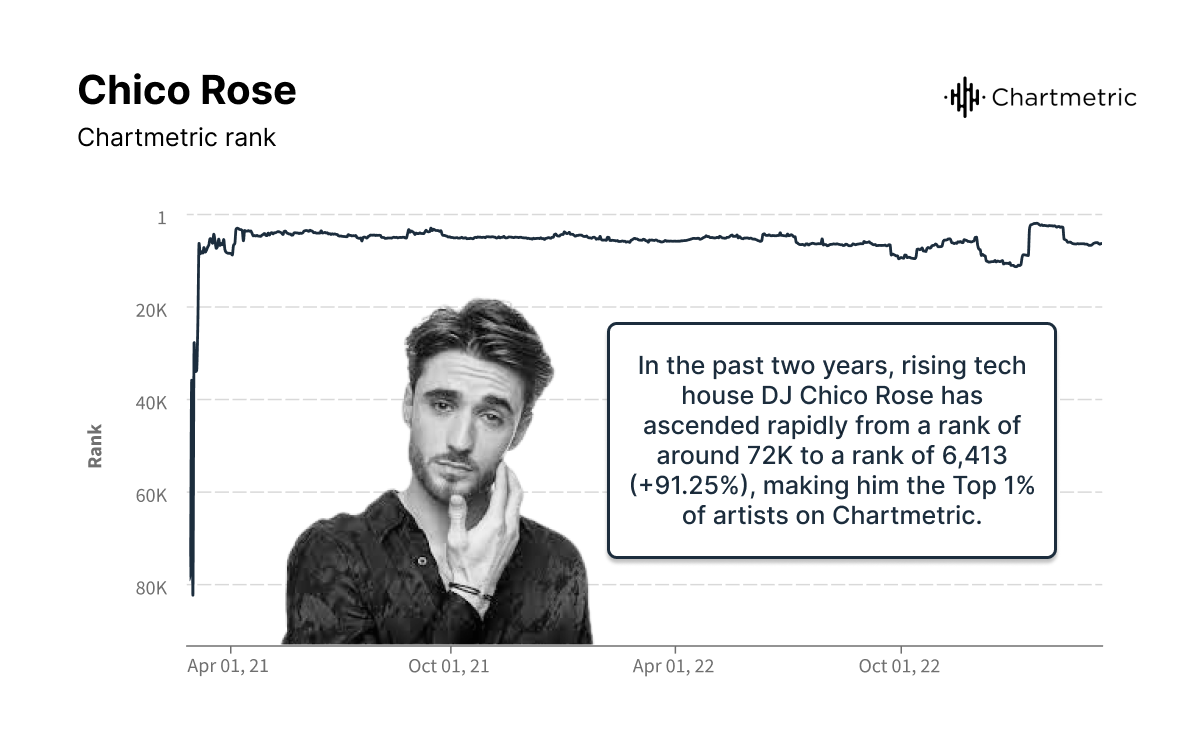

Rising Dutch Tech House DJ Chico Rose is also becoming a festival staple, and his refreshing twist on the genre has resulted in a surge in his popularity: After he released 2019 standout track “Sad,” featuring Afrojack, he gained 4.4M Spotify monthly listeners in less than two years.

While both John Summit and Chico Rose were added to the supporting lineup for Ultra Beach Bali, Summit’s Engagement Rank peaked at 2,127 (+33 percent) compared to Chico Rose’s ranking of 7,402 (+23 percent) two weeks after the festivals, indicating that Summit saw higher audience engagement than Rose did during that period.

However, Chico Rose did see audience growth in both global and Asian markets. In the six months since Rose played Ultra Bali, he increased his Spotify monthly listeners by 23.5K (10.7 percent), Spotify followers by 36.4K (24.1 percent), YouTube channel views by 25.5M (15.8 percent), and Instagram following by 52K (70.5 percent). Japan and Indonesia are also now among his Top 10 Instagram markets. Meanwhile, John Summit’s audience on Spotify and Instagram hardly reflects any Asian markets.

While it is worth noting the Western skew of digital platforms like Spotify and Instagram, the Chartmetric numbers signal a promising cue: Afrojack, a Dance-pop artist with whom Chico Rose frequently collaborates, only has Indonesia in his Top 10 markets, but Rose’s biggest IG followers consist of another region, Japan. This indicates a positive trend that may suggest something in his newer sound is resonating with the typically pop-hungry Asian audiences.

The Power of EDM Festivals in Asia

Asia has some of the most highly engaged and social media-savvy markets in the world, and amidst the backdrop of increasingly competitive battles for attention, artists who can foster audience connection through social media can more successfully convert casual listeners into fans. Getting a foothold in those markets is the difficult first step.

While it remains to be seen whether Chico Rose can translate his nascent Asia-based digital audience into local ticket sales and streams, international festivals can still serve as a bridge for exposure, introducing new sounds to new audiences and influencing global genre trends in turn.