Why some Japanese Artists are hard to find on Spotify

Japan’s enormous local music market means that the more the Japanese music industry embraces streaming, the bigger Japanese music artists will get worldwide.

by Miran Miyano from Chartmetric

Japan might be the second largest music market in the world, but there’s a catch. While digital consumption comprised almost 70 percent of global recorded music revenues in 2021, according to the Recording Industry Association of Japan, only 31 percent of Japan’s recorded music revenue came from digital consumption. In other words, Japan’s music industry is still heavily reliant on physical sales, which means more revenue, but it also means less digitization. Because much of the rest of the global music industry has fully embraced digital music consumption, that also means a certain amount of Japanese insulation from the rest of the world.

That insulation is reflected in a reluctance on the part of Japanese record labels and agencies to make deals with global streaming platforms, a strict intellectual property rights agenda with a concern for piracy, and a reliance on domestic streaming platforms that local music conglomerates have created: LINE music (owned by LINE, a free messaging platform) and AWA (owned by AVEX, a Japanese entertainment giant).

So, what does this all mean for Japanese artists who want to expand their global reach?

Johnny & Associates: A Giant Talent Agency With a Small Global Footprint

The accessibility of certain Japanese artists is determined by talent agencies themselves. For example, Johnny & Associates is a Japanese talent agency that is home to generations of popular male idols. Despite having 17 groups and over 20 solo idols, only one idol group is available for streaming on Spotify: ARASHI.

ARASHI is a 5-member idol group who debuted in 1999. With 41M+ records sold, they were one of the most popular bands in Japan. In 2020, the group announced their hiatus, and since then, their music has been accessible to overseas fans on Spotify, Apple Music, and Amazon Music.

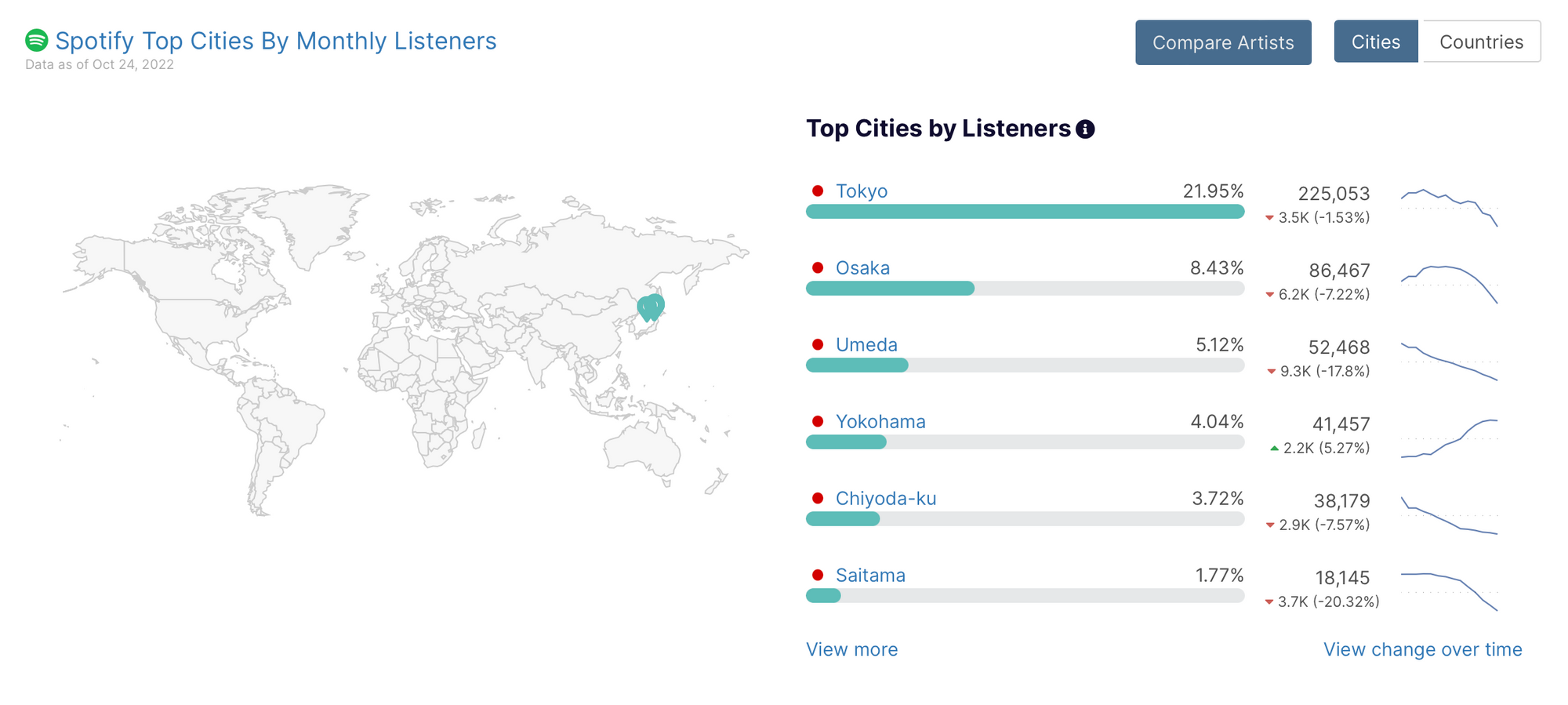

Since their Spotify debut in October 2019, they’ve accrued 1.9M followers, most of whom are likely in Japanese cities.

Spotify fan conversion rate has also been increasing steadily, suggesting that ARASHI is effectively converting listeners into fans.

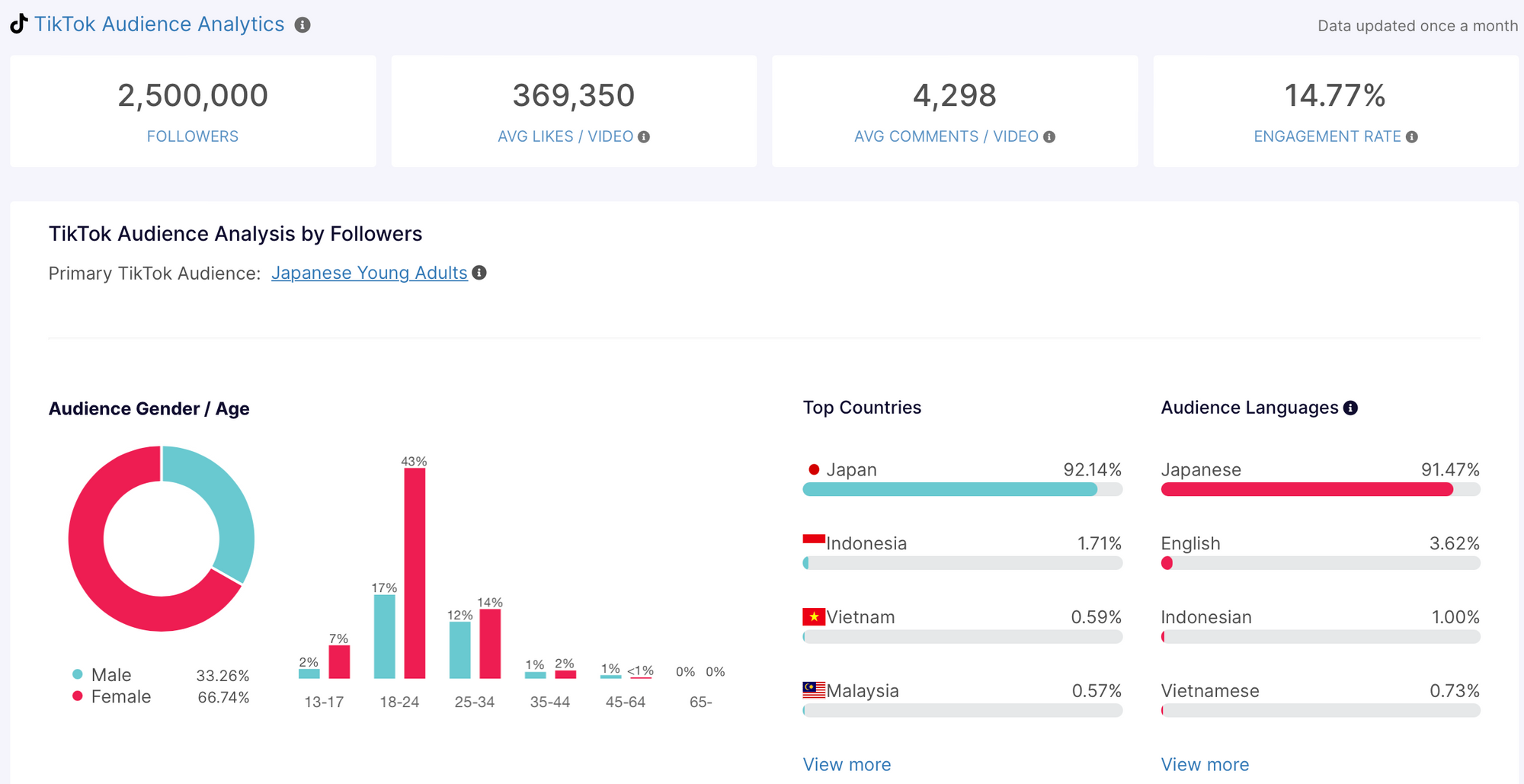

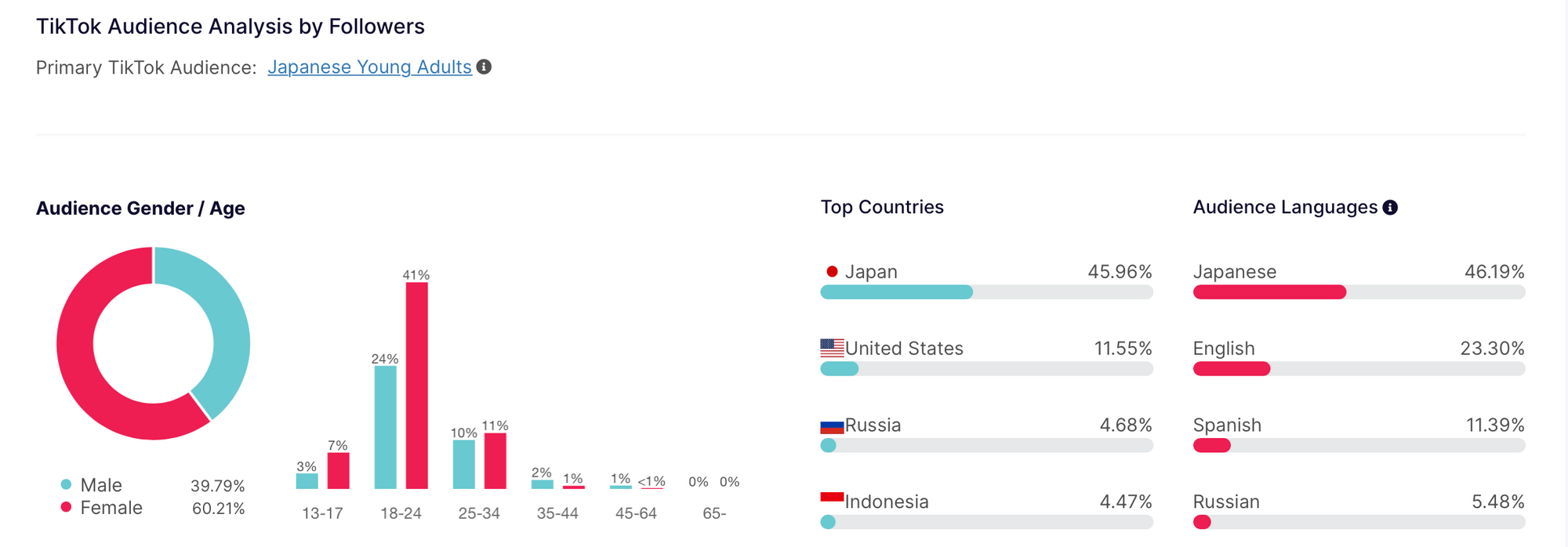

Like their Spotify Monthly Listeners, ARASHI’s 2.5M TikTok followers are also predominantly based in Japan, accounting for their primary TikTok audience of Japanese Young Adults.

Despite Johnny & Associates having other artists on their roster, they still have yet to release more of their artists’ music on global streaming platforms, and it’s likely due to the higher profit they generate from physical sales and a strong domestic fanbase, as evidenced by ARASHI. But what does that say about the potential for any Japanese artist to engage non-Japanese audiences?

Potential of J-Pop in the Global Music Scene

Outside of music, Japanese culture has been wildly successful at penetrating Western markets. Anime, for instance, is widely available on service platforms like Netflix and Crunchyroll, and some labels have started to promote their artists alongside Japanese culture that is already popular in the West.

SPY x FAMILY: Official HIGE DANdism

One of the most popular anime recently has been SPY x FAMILY, and its undeniable popularity has been reflected in music trends as well. Official HIGE DANdism, a Japanese Pop band formed in 2012, provided the opening song “Mixed Nuts” for the anime series. Following its Spotify release on April 15, 2022, the track has gone on to accumulate 58M streams.

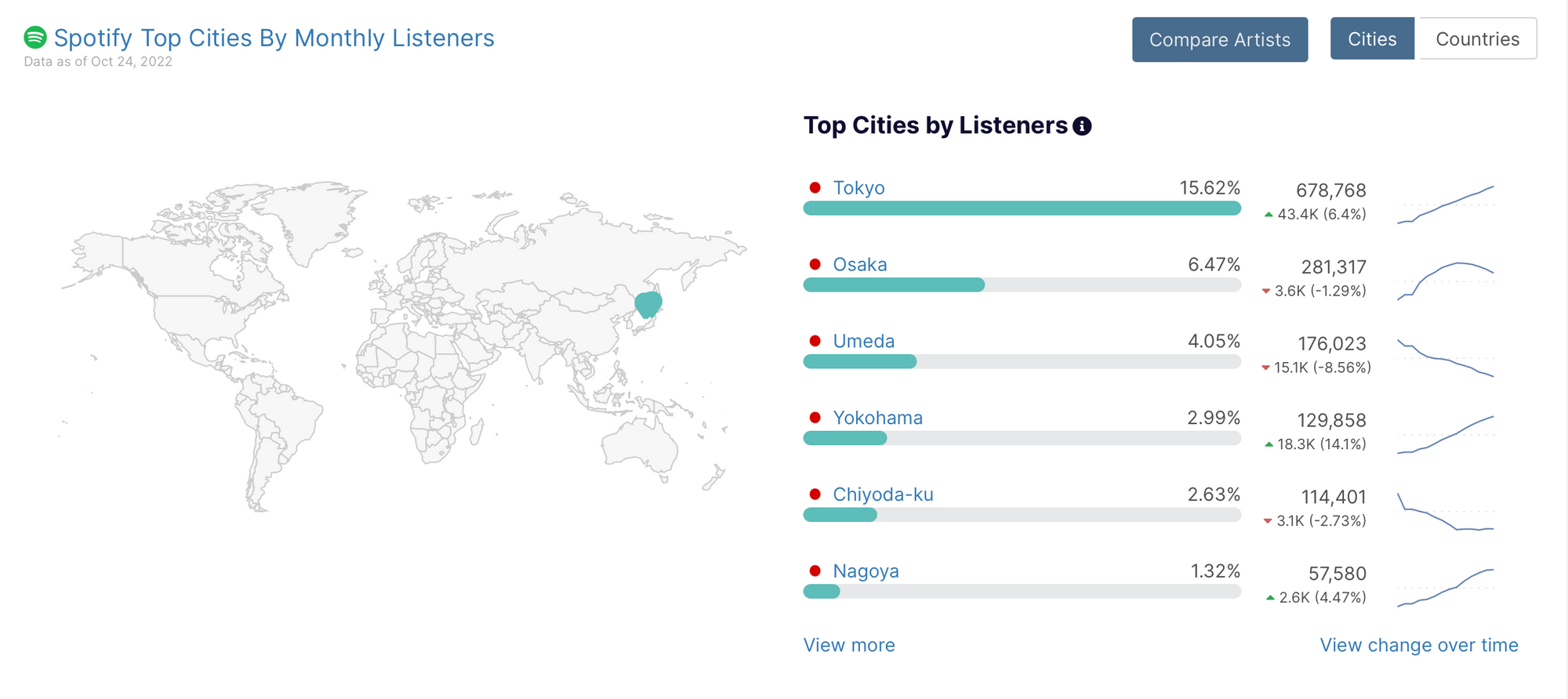

Like ARASHI, however, Official HIGE DANdism’s Spotify monthly listeners are still decidedly located in Japanese cities, indicating that even a potential global crossover can’t escape the domestic pull of the Japanese music industry.

Jujutsu Kaisen

Jujutsu Kaisen is another popular anime which aired from October 2020 to March 2021. In December 2021, the anime series released a film (Jujutsu Kaisen 0), which quickly became one of the Top 10 highest-grossing anime movies of all time, raking in $190M worldwide.

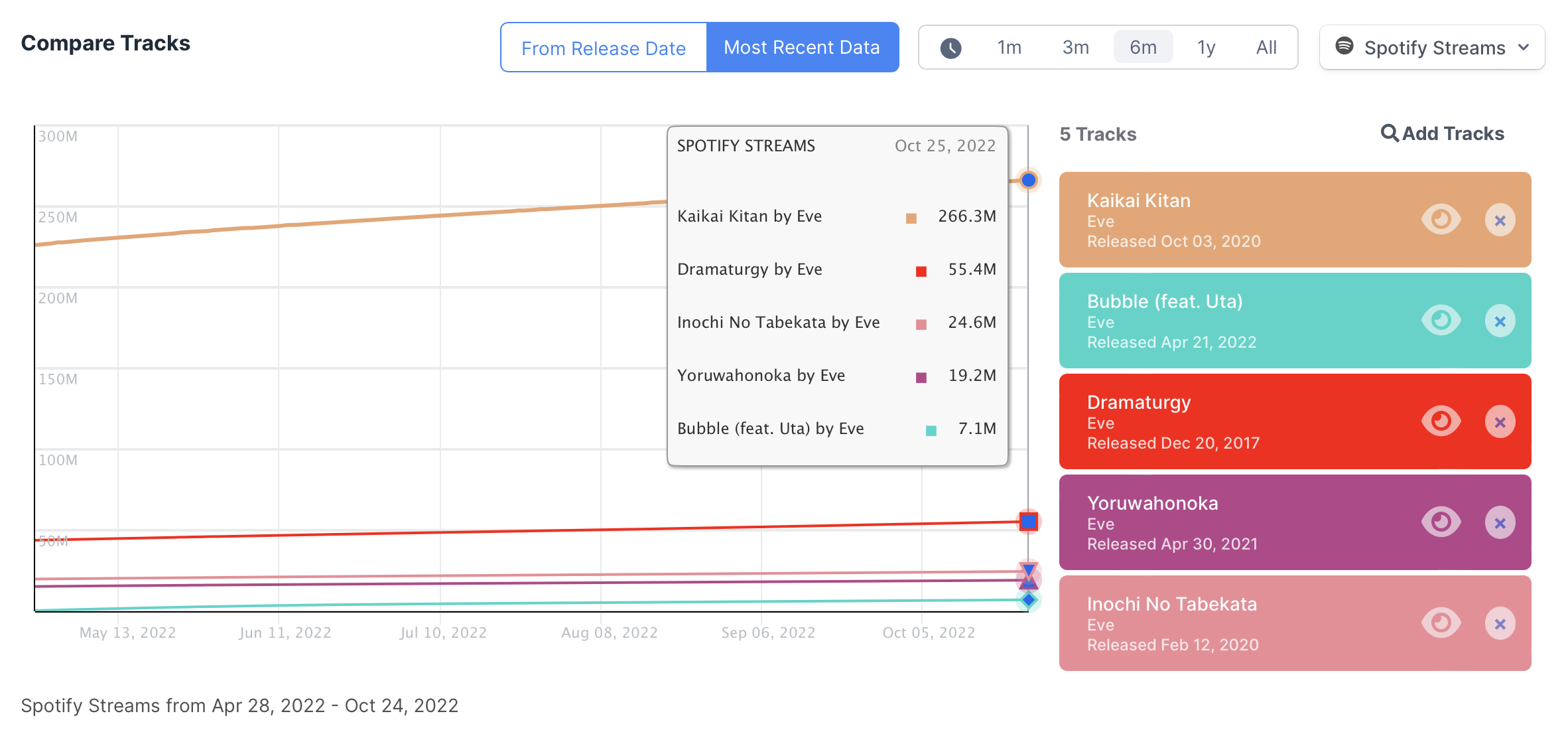

Eve, a Japanese male soloist, gained his popularity as the singer for the anime series’ opening song, “Kaikai Kitan,” which was released on October 2nd, 2020, and has far surpassed all of his other tracks with 266M+ streams.

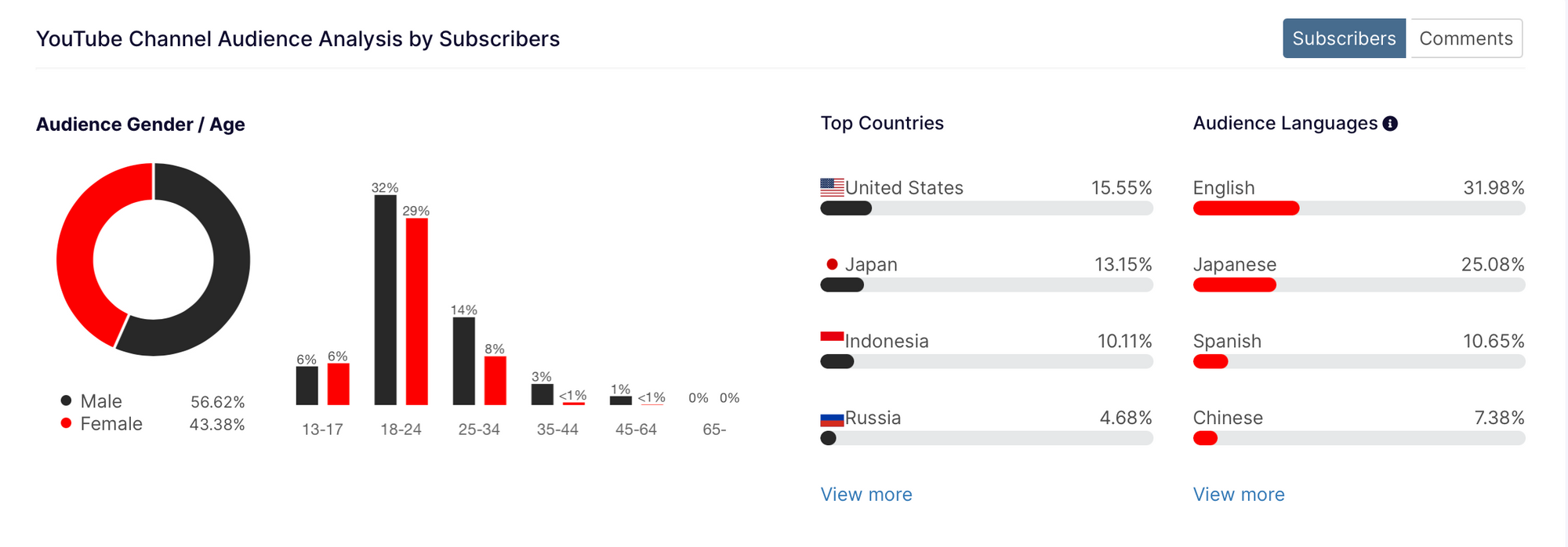

Surprisingly, the top country for Eve’s YouTube subscribers and the second top country for Eve’s TikTok followers is the United States, indicating there is a market for his music outside of Japan.

Whether or not this Japanese artist, or others like him, are able to grow that global audience will be largely dependent on Japanese labels and the Japanese music industry writ large. With such a huge domestic market and a burgeoning local music scene, Japanese music is a sleeping giant on the global stage. Should rules and regulations be relaxed, and should streaming take a greater hold on Japan as more people start to embrace technology, the Japanese music industry has the potential to expand into the world market, and to stand toe to toe with established music industries like South Korea.