Spotify fell 18% Wednesday and Joe Rogan had nothing to do with it (NYSE: SPOT)

UPDATED: Spotify stock {NYSE: SPOT] took a beating Wednesday falling as much as 13% in after hours trading. That was on top of the stock already dropping 5.75% during regular trading.

Spotify was still down 10.90% in pre-market trading Thursday morning or almost 17% overall.

Yesterday’s report from Spotify reflects a period prior to the current Joe Rogan controversy and #BoycottSpotify movement.

Slowing Growth

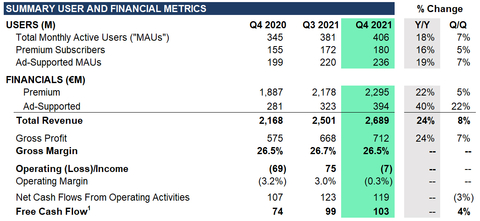

Spotify monthly average users (MAUs) grew 18% in 2021 to 406 million, the streamer reported and Premium Subscribers grew a bit more slowly at 16% Y/Y to 180 million in Q4. That’s strong growth for some, but down from earlier years, and investors were spooked by Spotify’s forecast Wednesday that more slow growth was ahead.

Weak Per User Revenue

Another cause for investor concern was Q4 Premium ARPU (average revenue per unit or user) which grew just 1% on a constant currency basis. While not specifically addressing Premium ARPU on Wednesday’s earning call, Spotify execs did predict similar or only slightly higher ARPU growth in 2022.

During Wednesday’s call CEO Daniel EK blamed ongoing investments in content for the lower ARPU and hinted that Spotify’s buying streak would continue.

Hi-Fi Delay

During the call EK blamed ongoing licensing talks for the delay in launching hi-fi audio on the service.

Read the full filing here.

MORE: Spotify Monthly Average Users up 18% to 406 million in 2021

Bruce Houghton is Founder and Editor of Hypebot and MusicThinkTank and serves as a Senior Advisor to Bandsintown which acquired both publications in 2019. He is the Founder and President of the Skyline Artists Agency and a professor for the Berklee College Of Music.