How decline in smart speaker sales hurts radio

Why have people stopped purchasing Alexas and GoogleHomes? And what does that have to do with radio? Keep reading to find out.

A guest post by Fred Jacobs of Jacob’s Media.

We’ve seen this one coming for a while. Like a slow moving ocean liner about to hit that iceberg, the sales of smart speakers have ground to nearly a trickle, confounding many experts who had predicted voice, largely driven by smart speakers, would rapidly replace search on a computer and mobile device keyboards.

In fact, devices like Apple’s Watch are now growing at a faster clip than smart speakers, an amazing data point. So, why the reversal of fortune for a technology that got off to a roaring start.

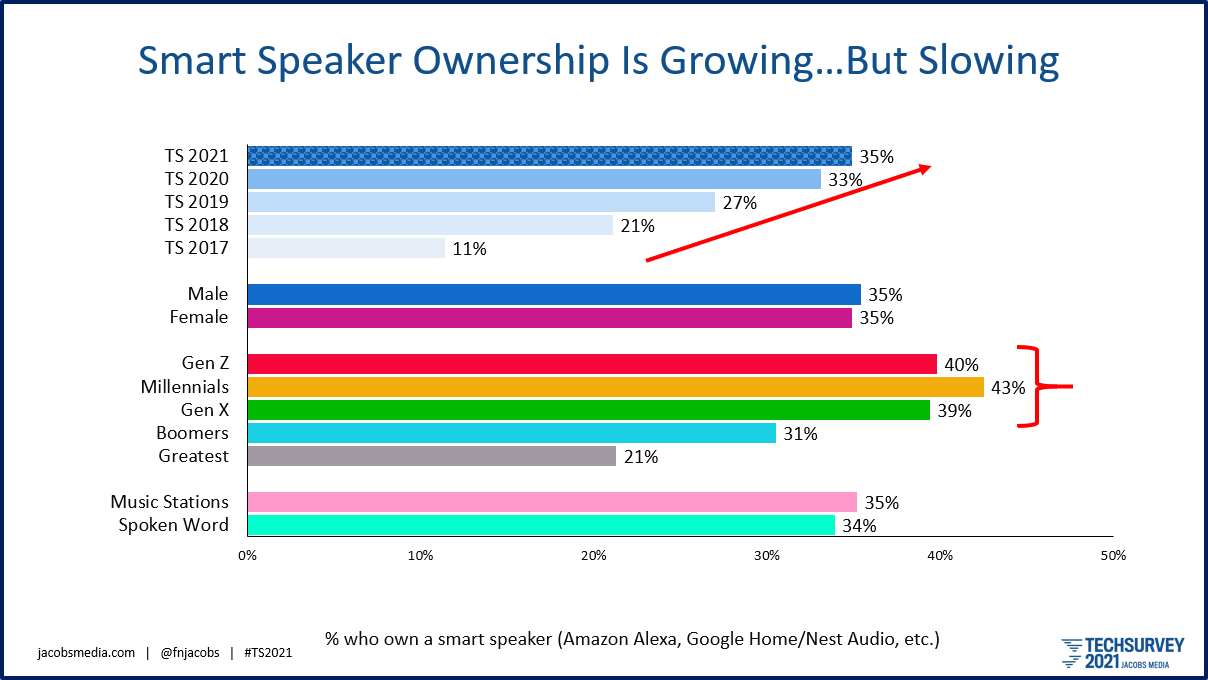

The data tell an amazing story. Techsurvey respondents knew all about the air going out of the growth balloon for both Amazon Alexa and Google Home devices. In the 2021 survey, we saw smart speakers hit the wall, after several years of rapid growth. In the early days when these devices were just coming to market, I referred to their trajectory as “iPhone growth.” We literally had not witnessed this level of customer acquisition since the iPhone, and before that, the iPod.

Looking at our most recent Techsurvey 2021, fielded last January and February, you can see why. Among our core radio listeners – pretty darn predictable of the overall population, by the way – smart speaker growth doubled in 2017-18. The increase continued more modestly the next year, and then the year after that.

And now in this year’s study, we’re showing that slightly more than one-third of our vast 40,000+ sample owns one of these devices, similar to our 2020 levels. But the growth spurt we witnessed just a few short years ago has cooled. In this year’s public radio version of Techsurvey, we’re also seeing the slowdown, despite heavy promotion by NPR and its member stations.

Last Friday, Inside Radio featured a story confirming this trend. In “Smart Speaker Market Growth May Have Peaked,” a new study by CivicScience is showcased.

The company conducts a tracking study. For the current quarter, more than 45,000 respondents participated. And the trends are clear: smart speakers are reaching a plateau. Now, we’ll see what holiday sales look like, but CivicScience matches the trajectory we’ve witnessed in Techsurvey.

Overall, their tracking study shows aa higher ownership – 39%. Still, the slowdown is consistent. In the nifty interactive chart (below), we can see how this looks generationally. Overall, they see flattening, with some potential growth coming from the youngest consumers.

The CivicScience study provides useful information on several fronts – how frequently smart speakers are used and by whom (yes, it skews young). It also turns out Amazon Prime members are significantly more apt to shop via Alexa. After all, that’s essentially why Amazon was interested in this technology in the first place.

So, what’s the impact of a smart speaker sales slowdown on broadcast radio? In Techsurvey this year, we learned the top “use case” among smart speaker owners is listening to a broadcast radio station.

And we know from our COVID tracking studies, conducted in three waves back in 2020, that smart speakers became a primary conduit for radio listening – especially in homes where there are no “regular radios.”

But why the obvious lack of momentum for this sector, especially at a time when consumer electronics have never been bigger. In the CivicScience study, that constitutes more than six in ten Americans who have not made the smart speaker plunge. In Techsurvey, it’s even more than that.

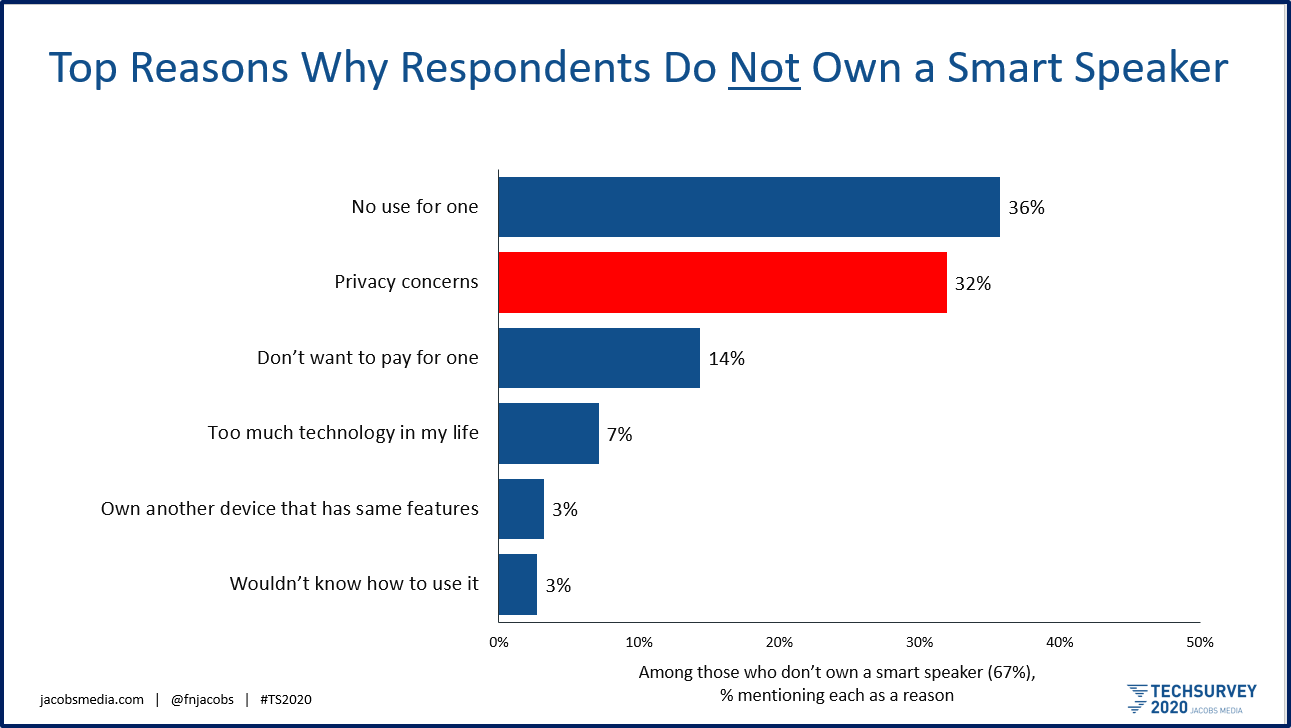

We were curious about why fewer consumers were willing to bring a smart speaker into their homes and places of work. So in our pre-pandemic Techsurvey 2020 (fielded in January and February – right before COVID), we asked those who had not purchased one of these devices to tell us the reason:

The top excuse – “no use for one” – can be a lot of things, from lack of knowledge of the technology to a simple rejection of these gadgets. But the second reason, mentioned by nearly one-third of those who don’t own a smart speaker, is more telling.

“Privacy concerns” has been a key stumbling block from the beginning. If you remember the early reviews and commentaries, especially on Amazon devices, there was this “it’s listening all the time” part of the devices’ narrative. In the scores of focus groups I’ve conducted since these devices first hit the market, I’ve heard the same trope:

“I’m not about to bring a device into my home that listens to my conversations.”

For smart speakers to become a true mass market success, this isn’t just a speed bump – it’s a core reason why millions have rejected the technology. And while Google and Apple have skillfully promoted their respective products, neither has adequately addressed this key barrier to ownership.

Of course, smart speakers DO listen to your conversation. So does your smartphone for those of us – that is, most of us – who give permission to opening its microphone. Same with your desktop, laptop, and your tablet. Your car is monitoring your voice commands, as well as tracking your locations and where you routinely shop, dine, work, and go to school.

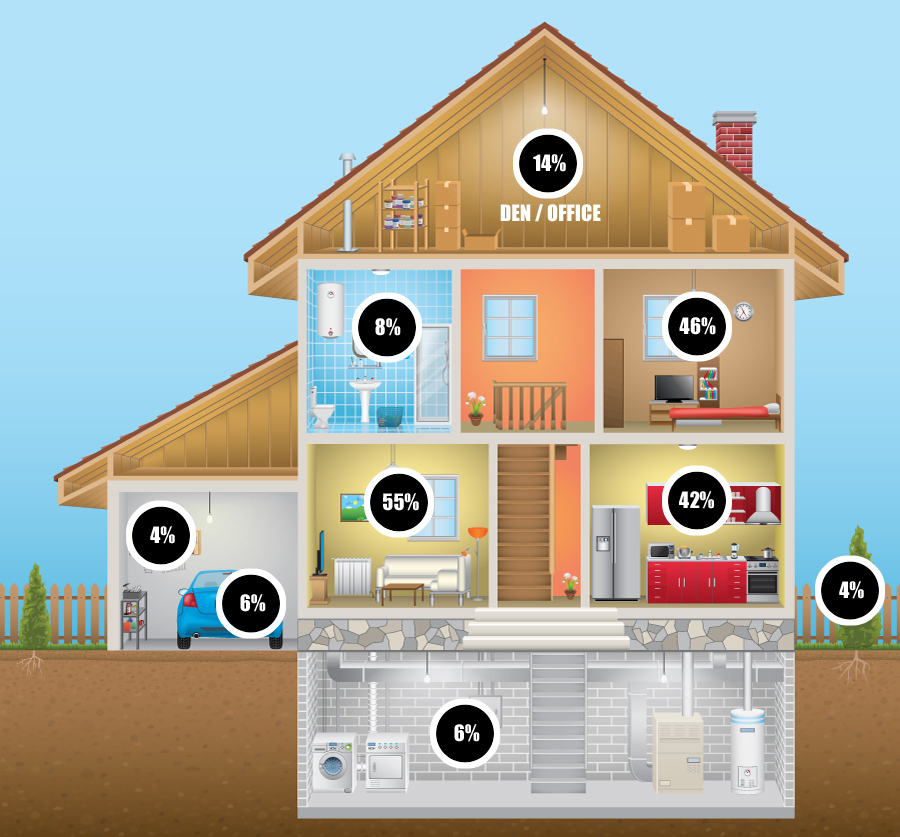

But even though smart speakers provide roughly the same utilities, and present similar privacy risks, conventional wisdom among the six in ten non-owners of Alexa or Google Home is wide-held and firm. Consumers simply do not trust these devices on dining room tables, bedrooms, kitchens, and dens.

While privacy concerns are real, it is essential for both Amazon and Google to address them at some point. Oddly enough, Apple has failed miserably in the smart speaker market – or let’s refer to it as “voice.” There was a time not that long ago where the first voice assistant many of interacted with was Siri. While “she” is still a popular voice assistant, Alexa rules, especially in the U.S. where Amazon has managed to maintain a huge lead.

But what if Apple rethought their progress with their HomePod line of products? What if they relaunched a new line of these devices that is truly different from the incumbents’ products?

After all, Apple didn’t invent the mp3 player, the smartphone, or the smart watch? Instead, they studied the existing players in these verticals, and used design, innovation, and the customer experience to build a a better mousetrap. Apple ended up creating the best in class in all three of these tech verticals, and then marketed them all brilliantly.

Maybe for Apple, the entry point to the smart speaker “drag race” is privacy. Imagine if Apple marketed its next line of these devices with the promise it would never “listen” to conversations – that the microphone on the new, improved HomePod is “off” until the consumer issues a voice command. Given Apple and Tim Cook’s penchant for mobile app privacy, this strategic angle could end up being a “steel sword.”

Perhaps the Cupertino crowd is getting more serious about their smart speaker division. Introduced last year, the Apple HomePod Mini (pictured) may be a step in the right direction. It comes in a number of cool colors, and is more competitive priced at $99. But Apple has not given consumers who have brought a smart speaker into their homes a reason to switch. Nor have they motivated their fan boys and girls to buy their version of the smart speaker.

And given how many homes are built with Google Home/Nest technology baked into new and remodeled homes, the longer Apple sits this one out, the harder it will be to become competitive in this space.

Why does any of this matter to radio? After all, the transmitters and towers are working fine. During COVID, in particular, millions of consumers learned how to stream on computers, tablets, and of course, their smartphones.

But many began to use smart speakers for streaming. Techsurvey 2021 shows the #2 “use case” of these devices is listening to broadcast stations (#1 is listening to DSPs, like Spotify and Pandora.) But in our Public Radio Techsurvey from this year, listening to a radio station on smart speakers is the top “use case.”

We have continued to urge (OK, cajole) Jacobs Media clients, as well as all of you, about the importance of clearly promoting that a smart speaker is a radio. In fact, it’s easier to use. Stations can be discovered and tuned to with a simple voice command.

And obviously, it is easy to switch stations by simply shouting out another command. Moreover, innovative broadcasters have developed “skills” that have embedded content you may not hear on their air, websites, or apps.

At the rate we’re going with COVID, it is impossible to predict just how long it will be until commuting patterns and routines return to a stronger, more consistent level. That means that for the foreseeable future, millions will be working from home, scraping together work in the gig economy, or retiring. In other words, they won’t be driving as much.

It is in broadcast radio’s best interest to promote the growth of smart speakers in any way, shape, or form. That might mean giving them away. Consumers aren’t likely to head to Best Buy to purchase a boom box. But they are far more likely to purchase an Amazon or Google smart speaker.

Broadcasters may not “own” this technology (Apple and Google make the rules), but the data show these devices are being used with increased frequency to listen to radio.

Helping the audience overcome the privacy issue, teaching them how to listen to your station, and reinforcing these devices are fun and easy to use could help the medium and its transition to digital.

And a Jacobs Media “pro tip” I’m more than happy to pass on. This is the time of year when Alexas, GoogleHomes, and maybe even HomePods will end up under a tree. December is a target rich month for promoting smart speakers with frequency, creativity, and enthusiasm. (It’s the same with mobile apps, as smartphones and tablets will continue to be popular gifts.)

Fred Jacobs founded Jacobs Media in 1983, and quickly became known for the creation of the Classic Rock radio format.

Jacobs Media has consistently walked the walk in the digital space, providing insights and guidance through its well-read national Techsurveys.

In 2008, jacapps was launched – a mobile apps company that has designed and built more than 1,300 apps for both the Apple and Android platforms. In 2013, the DASH Conference was created – a mashup of radio and automotive, designed to foster better understanding of the “connected car” and its impact.

Along with providing the creative and intellectual direction for the company, Fred consults many of Jacobs Media’s commercial and public radio clients, in addition to media brands looking to thrive in the rapidly changing tech environment.

Fred was inducted into the Radio Hall of Fame in 2018.