Music ‘Trigger Cities’: Spotlight On Latin America

In this third part in a series exploring music "trigger cities", Jason Joven pf Chartmetric takes an in-depth look at Latin America's music consumption stats to explore how listeners there are precipitating the exponential growth of Latin music's global popularity.

__________________________

Guest post by Jason Joven of Chartmetric

Trigger Cities Mini-Series: [Part 1-Concept] [Part 2-Southeast Asia]

In May 2019, we explored Chaz Jenkins’ concept of “trigger cities”. In June 2019, we applied some of those global streaming ideas to Southeast Asian cities: Bangkok, Jakarta, Ho Chi Minh City, Singapore, Quezon City and Kuala Lumpur.

We took a platform-centric approach, dissecting the YouTube views, Spotify monthly listeners, Shazam chart occurrences and Instagram followers of those cities, and got a feel for who they favored and on what platforms.

Today, we’ll do the same in Latin America.

Mainstream America’s “Latin Explosion” (1999)

If you weren’t of age in 1999 (or can’t remember), the 41st Annual Grammy Awards happened in Los Angeles, California. Ex-Fugees member Lauryn Hill dominated the night award-wise (5) with her Album of the Year, The Miseducation of Lauryn Hill, taking Best New Artist as well. The power ballad “My Heart Will Go On” took Song of the Year and Celine Dion, of course, took Record of the Year with it, reminding us all how powerful a great song can be with a memorable narrative, provided by James Cameron’s blockbuster film, Titanic.

“Consigue con honor /La copa del amor / Para sobrevivir y luchar por ella / Do you really want it? Do you really want it?” — Ricky Martin, “La Copa de la Vida / The Cup of Life” (1999 Grammy performance)

However, a Spanish/English live performance by a young Puerto Rican artist named Ricky Martin, proved to be one of the most memorable points of the night. The ex-Menudo member and soap actor was eager to move into his next career phase, and his stirring, lively Latin crossover performance of “La Copa de la Vida” is considered by many to have sparked the 1999 “LatinExplosion” that others like Marc Anthony, Enrique Iglesias, Shakira and Jennifer Lopez (sensing business opportunity in the video above at 4:11) rode into the US mainstream. Even American boy band *NSync, just about to hit the apex of their group’s popularity, did a duet with Cuban-American artist Gloria Estefan, by then already a 20+ year industry veteran.

The Latin Explosion was set to change America forever…though as Los Angeles Times writer Agustin Gurza puts it:

But it never happened. Instead, the Latin boom imploded…The Latin music industry, once drunk with heady expectations, went into a doozy of a tailspin…What happened? The answer goes well beyond the vicissitudes of pop music tastes…It has to do with long-term patterns of assimilation, historic resistance to foreign languages, and the overwhelming dominance of American marketing in the world…the Latin Explosion simply demonstrated once again this country’s capacity to absorb outside cultures and neutralize them. It proved that any Latinization of America inevitably involves the Americanization of Latinos. — Agustin Gurza, “1999 was the year…” (LA Times, 2004)

Gurza goes on to reveal that most of 1999’s Latin superstars were all in fact, Sony artists. He quotes Rolling Stone’s deputy managing editor at the time, saying “The Latin rock explosion was engineered by Sony….They put tremendous marketing muscle behind all of this, believe me.” Even today, Sony Latin artists have the lion’s share of Spotify’s Viva Latino and Baila Reggaeton playlists, the 4th and 5th most followed in Swedish platform’s ecosystem.

The formula: Play down the polyrhythms, play up the “hot and sexy” stereotype, and keep the lyrics generic, and mostly in English….All immigrant groups…have been offered the same Faustian bargain. To succeed, Frank Sinatra could not be too Italian, nor Bob Dylan too Jewish.” — Agustin Gurza, “1999 was the year…” (LA Times, 2004)

Thus however contrived it initially was, Latin America (unlike SE Asia) has arguably played a much more active role in American music culture. Between 1955 and 1999, 455 singles by 117 Latin artists hit the Billboard Top 100, including Chicano Richie Valens and the Miami Sound Machine.

Started in 1997, the Latin Recording Academy (formed by The National Academy of Recording Arts & Sciences in the US) annually holds their own Latin Grammy Awards. They are currently gearing up for the 20th Annual Ceremony in Nov 2019, a gloriously global event (focusing on Spanish/Portuguese content from anywhere in the world) whose separate existence signals how expansive and deep its music influence runs.

And today? We have streaming, delivering a second Latin wave in 21st-century America that is certainly one part commercial — but more than ever — several more parts organic and decentralized.

We believe those parts are actually cities, and they come from where any Latin wave naturally should come from: Latin Americans themselves.

Seven Latin “Trigger” Cities Hungry for Music…And Then Some

If only for a sense of familiarity, this article will focus on the seven most populous cities of Latin America (in descending order) — Mexico City, São Paulo, Buenos Aires, Rio de Janiero, Bogotá, Lima and Santiago — ranging from populations of 21.6M (Mexico City) to 6.7M (Santiago).

Looking at YouTube views and non-unique Spotify monthly listeners for a sample week period in June 2019 however, the city populations only roughly translate to streaming consumption metrics. (Note that these metrics are a subset of the 1.6M most popular artists that Chartmetric was tracking at the time of data capture.)

Bogotá, despite having less than half (10.7M) of Mexico City’s population, took the #1 spot in YouTube views that week with 26.5M views across 1.6M+ artists. The Mexican capital, however, was not far behind with 24.8M, and the two cities seem to be leading YouTube’s consumption in the region, with Lima a distant #3 with 17.1M views.

Portuguese-speaking São Paulo (9.8M views) and Rio de Janeiro (9.2M views) fall lower on the scale in the #5 and #6 positions, respectively, while Argentina’s capital of Buenos Aires had almost half as many at 4.8M views in the #7 position.

To help give a sense of scale, NYC — the United States’ largest city at 8.3M people — sits between Santiago (#4) and São Paulo (#5) with 11M views that week.

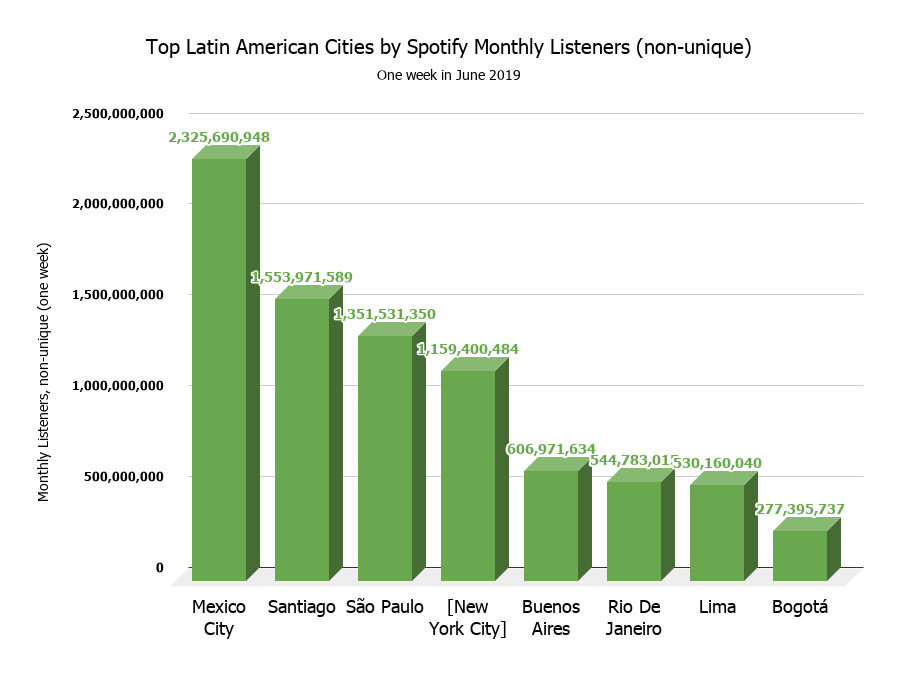

On Spotify, Mexico City takes the top spot with 2.3B non-unique monthly listeners (please refer to Part 1 to understand this admittedly odd metric), and far outstripping Santiago in the #2 spot with 1.5B non-unique monthly listeners (MLs). Santiago and São Paulo (#3–1.3B) seem to be in a class all their own, and are comparable to New York City at 1.1B that week.

However, there is quite a drop-off with Buenos Aires (#4–606M), Rio de Janeiro (#5–544M) and Lima (#6–530M) forming similar sized Spotify markets, and then Bogotá coming in #7 with 277M non-unique MLs.

The most notable takeaway at the city-level, comparing YouTube and Spotify, is the movement of Bogotá — Bogotanos are voracious for YouTube yet relatively cool on Spotify consumption (relative to the other cities). Also notable is São Paulo’s movement from a lower-tier on YouTube views and a higher-tier for Spotify non-unique MLs…it seems the platform has done a great job at penetrating the biggest city in Brazil.

It’s good to remember, with all the “top” cities taking all the glory, that less well-known Latin American cities still have very sizable streaming figures. During that same week, four Mexican cities (Ciudad Juarez, Tijuana, Mérida, and Ecatepec [a Mexico City suburb]) watched videos on YouTube ~2 to 3M times, as well as the capitals of La Paz (Bolivia), Montevideo (Uruguay) and Managua (Nicaragua), the first Central American city for us to see in these metrics.

Managua, with 2.9M views in one week and just 973K people there to do so, are streaming YouTube videos at almost 3x their population. Bogotá is the same, at almost 2.5x. New York City in the meantime is much lower at 1.3x views/person for that week. So while it’s been a long known fact to say Latin American cities’ appetite for music on YouTube is huge…we’ll confirm that to still be true today.

For Spotify, interestingly enough, three entirely different Mexican cities also show strong streaming numbers (Guadalajara, Monterrey, Puebla City), while the platform’s strength shows to be nation-wide in Brazil, tacking on Curitiba, Belo Horizonte and capital city Brasilia as strong Spotify cities. Córdoba, Argentina’s second most populous city, tags on as another.

All this to say that in Brazil — and especially in Mexico — there is a broad set of music lovers streaming music on their smartphones and devices, and they’re not just in the bigger, famous cities. A bus tour through these huge nations would be quite the reasonable move if you’re an artist finding resonance in these markets.

Shazam Indirectly Hints at Reggaeton & Latin Trap’s Power…and its Limits

When looking at frequently occurring genre tags in Southeast Asia on each city’s Shazam Top 100 tracks, there was a clear distinction of Pop winning out over all other genres. For the US, it was strongly hip-hop, and for western Europe, a more balanced genre distribution gently leaning towards Pop.

However, just like Southeast Asia, Latin American cities show a lack of “Hip-Hop/Rap” genre tags…but it’s not that Latin listeners there don’t love the sound…they’ve just cultivated an industry of their own using it: reggaeton and Latin trap.

That unmistakable push-and-pull reggaeton beat and the drawn-out 808 bass notes of Latin trap have both been filling dance floors for years now, with artists from Puerto Rico (where reggaeton originated in the 1990s) and Colombia (where it’s experienced its second wave in the 2010s) leading the way.

Frequently on Baila Reggaeton (the 5th most followed Spotify playlist at 9.5M followers), Daddy Yankee, J. Balvin, Karol G, Ozuna, Nicky Jam, Maluma, Farruko and others have also built permanent homes on the YouTube/Spotify/Apple Music/Billboard charts with never-ending reggaeton hits in the post-Despacito era.

Latin trap, with names like Bad Bunny, Messiah and Anuel AA defining the more edgy genre, have been the Spanish language incarnation of American Southern trap, and many of these artists criss-cross between sounds. Even Shakira herself, who started her career out as an eccentric rocker, has several reggaeton hits now, including “Chantaje” with Maluma with over 2.4B YouTube views.

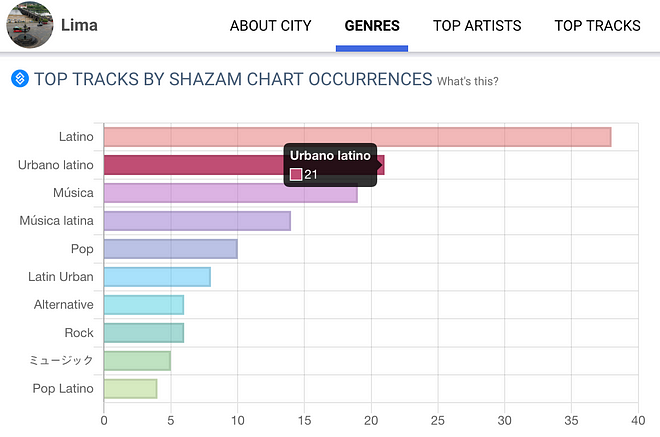

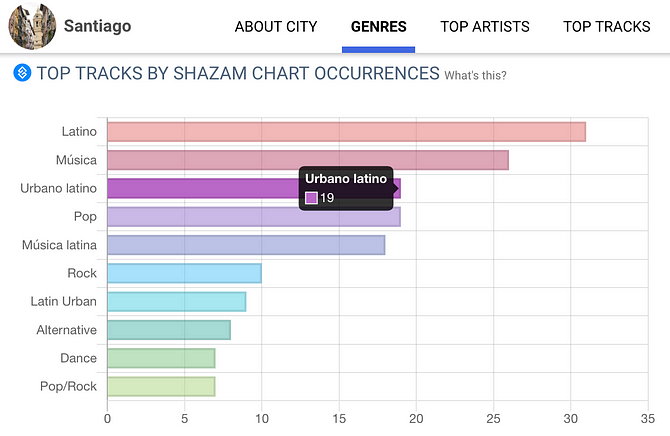

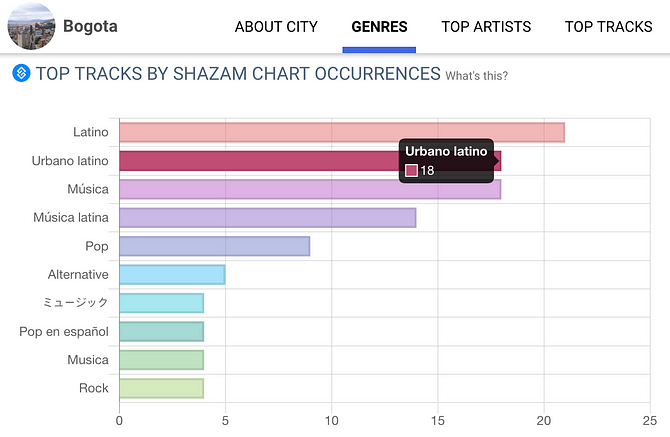

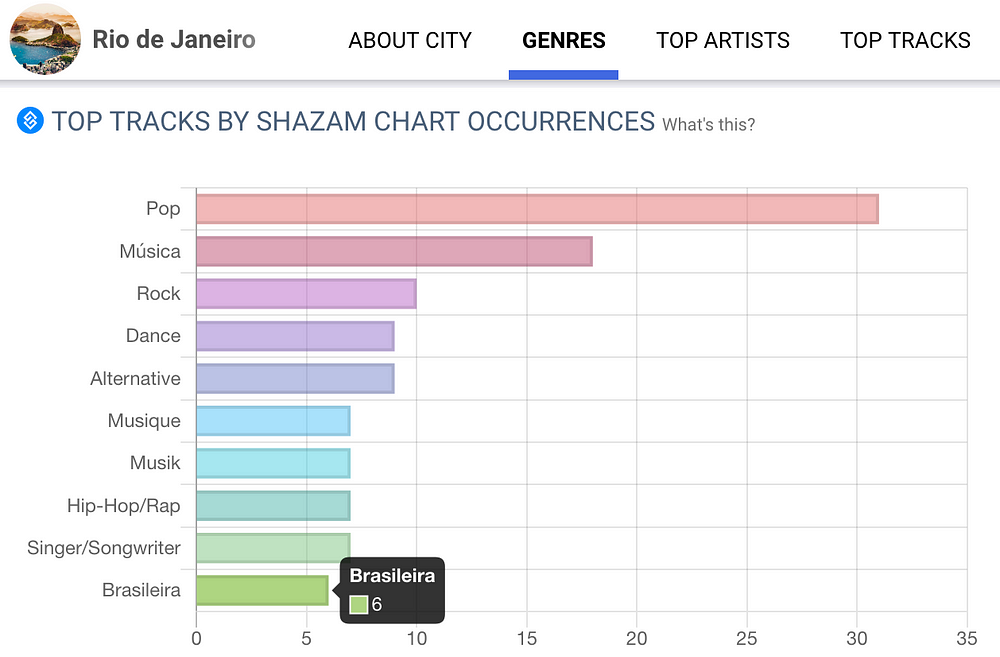

Our Shazam chart occurrences, which aggregate genre tags in the Top 100 tracks in each city over the past month, unmistakably point out “Urbano latino” (currently reggaeton & Latin trap records) as the most popular distinct genre in three of our seven Latin cities: Lima with 21 genre tags, Santiago with 19 and Bogotá with 18. (“Latino”, “Música”, and “Música Latina” were ignored due to their generality).

Mexico City (10 genre tags) and Buenos Aires (10) show a cooler love for the urban sound, both curious about Pop and Buenos Aires particularly more about Rock and Alternative. It’s worth remembering that these are genre tags for Shazam top tracks, so it involves a sense of curiosity and likely an already-popular song that is being played out in public.

Mexico City’s interest in Pop, true to its moniker as the “world’s music-streaming mecca” by Spotify, is as likely to involve a Latin artist track like the acoustic ballad “Christina” from Sebastian Yatra as it is “I Don’t Care” from Anglo acoustic ballad king Ed Sheeran…both showing up in the city’s top pop tracks. Even K-pop band BTS made the top 100 Shazam/Mexico chart 15 times in the past month.

Porteños (Buenos Aires citizens), however, show a sub-current of Alternative/Rock leanings that are also, interestingly, catalog-oriented. Whether it’s “My Immortal” from Evanescence (7 chart occurrences), “Somebody That I Used to Know” by Gotye/Kimbra (10) or “Shoot to Thrill” by AC/DC (9), Buenos Aires is simultaneously curious about frontline pop fare and catalog rock hits.

Though MIDEM’s 2019 Latin America white paper had a theme of unifying both Spanish and Portuguese markets into one Latin America, São Paulo and Rio de Janeiro city Shazam charts beg to differ.

“Urbano latino” didn’t show up at all, with Brazilian-native genres such as “Sertanejo” (Brazilian country music) and “Brasileria” (catch-all for Brazilian music) asserting their unique identity in the region, and Pop/Rock/Dance all showing strongly in the past month for both cities.

Dance hits from Marshmello, Calvin Harris and Avicii show up in both cities, as well as alternative tracks like “Mystery of Love” from Sufjan Stevens and for whatever reason, “Shoot to Thrill” by AC/DC again (8 chart occurrences in São Paulo and 11 in Rio de Janeiro).

All this to say: a few Latin cities seem to be fully on-board the reggaeton/trap train, a couple sort of care but are into their own thing, and the Brazilian cities couldn’t care less about it…at least on Shazam, in the past month.

So if you’re targeting a social media campaign for a reggaeton or rock release…it’s worth being more precise here, rather than shot-gunning to all Latin American cities.

Instagram: Latin/US Artists Unite, Local Ones Divide…And YouTubers Go Mainstream

If we learned anything in Southeast Asia, it’s that platform behavior can differ greatly. On Instagram especially, we found that it by far siloed the cities in terms of which artists they were most interested in, while tastes on YouTube, Spotify or Shazam had more overlap.

In Latin America’s Instagram world, there’s more mixing of borders…but only slightly.

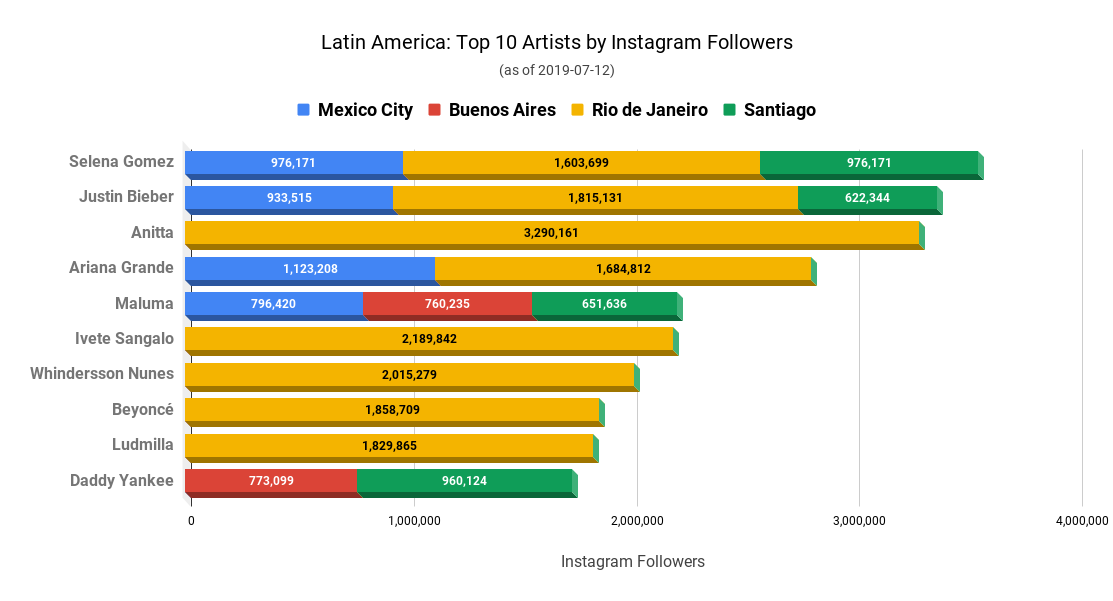

When we aggregate each of the seven cities’ top 10 most followed Instagram artists, and then sort for the most followed in the entire region, there’s quite an interesting mix of artists and city-mixes that fall out.

(Note: Our data source cuts off each artist’s top IG cities to the top 10 or so, therefore these aggregations are not exact, but we believe are accurate enough to draw conclusions about larger trends.)

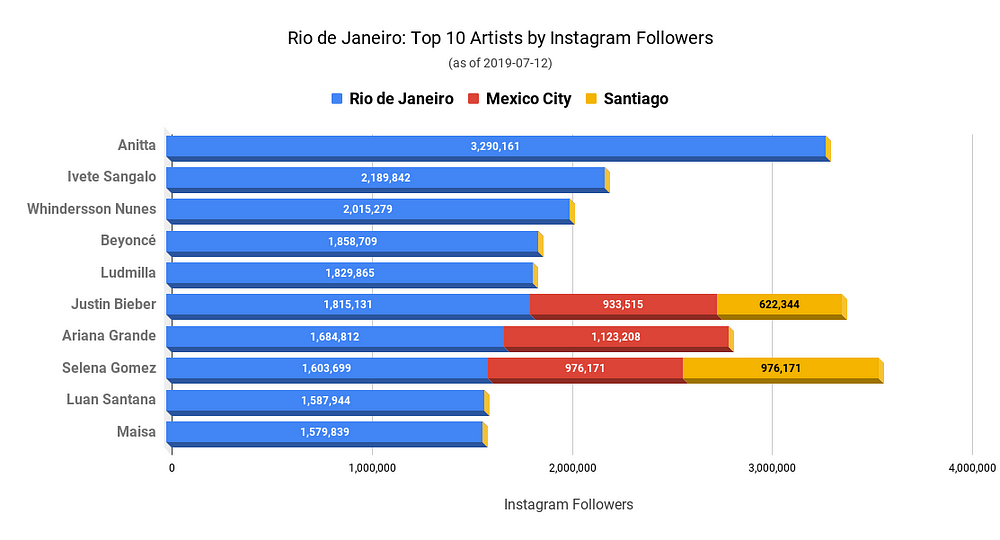

Four of the top 10 are US artists: Selena Gomez (#1 at 3.5M+ followers), Justin Bieber (#2 at 3.3M+), Ariana Grande (#4 at 2.8M+) and Beyoncé (#8 at at 1.8M+), who interestingly seems to only be most followed in Rio de Janeiro, getting all of her top IG followers from the Cidade Maravilhosa.

Another four Brazilian artists dominate the visually-centric social platform: pop queen Anitta (3.2M), industry icon Ivete Sangalo (2.1M), comedian-entertainer Whindersson Nunes (2.0M) and the Beyoncé-inspired Ludmilla (1.8M).

Colombia’s Maluma (#5 at 2.2M) and Puerto Rico’s Daddy Yankee (#10 at 1.7M) are the only Latin artists who are able to pull together more than one Latin city in their top IG cities, Maluma pulling off Spanish-language cities Mexico City, Buenos Aires and Santiago, and Daddy Yankee only the first two.

So a love of US/Brazilian/Spanish-language artists reigns supreme on Instagram for the region.

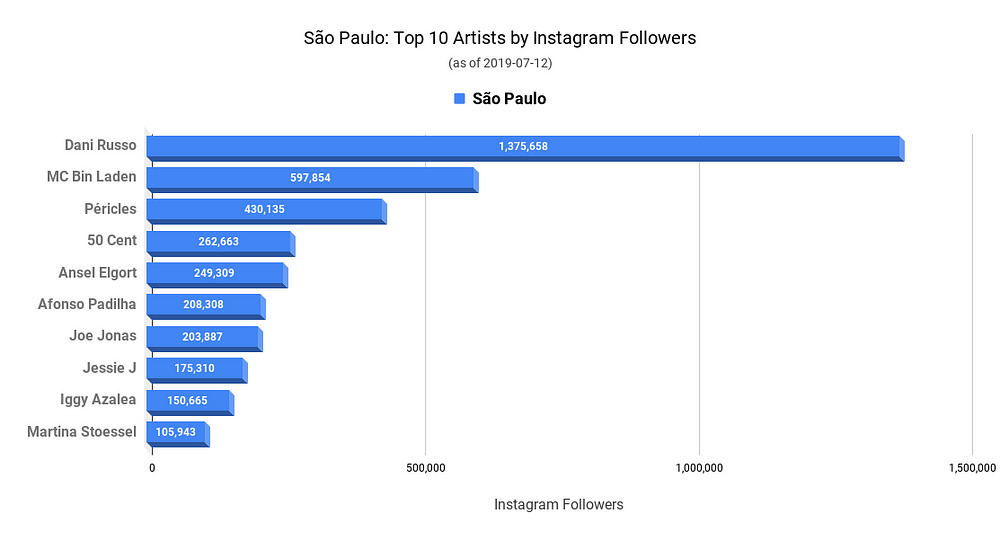

Language, of course, still remains a cultural barrier between Brazil and the rest of the biggest Latin American cities, and so the Instagram behavior echoes what we’ve already witnessed on Shazam. But it is also where we begin to see differences between São Paulo, the country’s premier business center and concrete jungle, versus Rio de Janeiro as one of the most naturally picturesque (in beaches and people) places to go in-country.

First, Cariocas’ (Rio residents) sheer love of the platform outshines that of the Paulistanos’ (São Paulo residents), with all of Rio’s top artists having local follower counts in the seven digits, and only one of São Paulo’s (YouTuber Dani Russo) having such size. Second, there is interestingly no crossover in either of their top 10s, despite both being Brazilian cities. Third, both follow US artists, but while Rio’s are today’s biggest artists (e.g., Ariana Grande, Justin Bieber), São Paulo’s seem to be relatively offbeat (e.g., 50 Cent, Ansel Elgort).

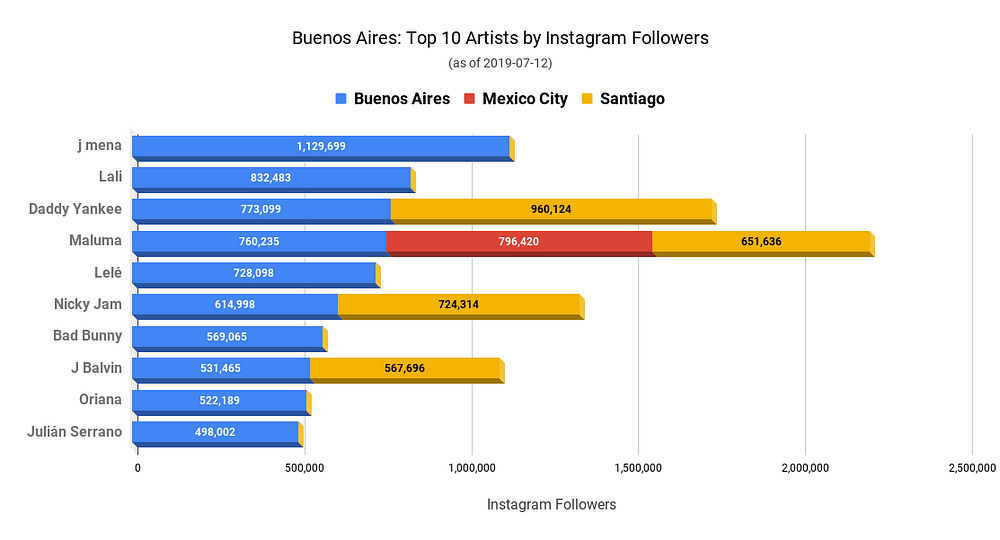

Turning to Buenos Aires and Mexico City, we continue to see the Shazam trend of Buenos Aires citizens marching to their own drummer, with their #1 IG-followed artist being Argentine actress-singer j mena (1.1M) among others (e.g., Lali and Oriana). We also see Mexico City continue to be more connected to the wider Latin American/global scene (e.g., Maluma, Selena Gomez, Ariana Grande).

We also discover a trend of YouTubers in Latin America going mainstream: Julián Serrano (Buenos Aires’ #10), Yoseline Hoffman (Mexico City’s #9), Dani Russo (São Paulo’s #1) and Whindersson Nunes (Rio’s #3)…and surely more past the top 10 in each city.

YouTube’s influence in the region becomes so clear that even in Instagram data, we see YouTube personalities leveraging their ability to draw attention in one platform, and translate that into “mainstream” success (Russo’s video below is Canal KondZilla, the 2nd most subscribed YouTube channel in the world at 50M+).

Last but not least, we have Santiago (Bogotá and Lima did not return significant IG follower results relative to their populations), which continues its Shazam characteristic of tracking with global trends quite well. Both a lover of US artists (e.g., Nicki Minaj, Selena Gomez) and Latin ones (e.g., Anuel AA, Maluma), they seem to be on top of American pop and Latin reggaeton/trap hits and the artists making them.

Of note is a single Chilean-American artist, Paloma Mami (646K followers at #6), who exports Latin trap-influenced soul/R&B records from the Sony Music Latin imprint. Originally from NYC and with the resources of a major US label, she has the advantage of growing up with the kind of American swagger that is sometimes hard for foreign artists to tap into, yet has the Chilean cultural and linguistic ties to also add nuance to her work.

The fact that it’s resonating so well in Santiago on a social platform that necessitates an interest in their daily lifestyle is not only a great sign for Mami, but also any Latin-American artist looking to spread their wings in the region. She wouldn’t be the only Latin-American to do so, just ask Nicky Jam.

2019: A Strong & Steady Latin Boil, No Explosion Necessary

While not a perfect parallel, what happened in 1999 for Latin music in America is a bit like what happened for K-pop when “Gangnam Style” came out in 2012. A ridiculously large amount of attention, little time for it, a very amused American mainstream…and then relative silence. Seven years later, what followed next for K-pop needs little introduction at this point, even in Latin America.

LA Times’ writer Gurza noted that UCLA music historian Ruben Guevara tested his Anglo students in 2004 by playing music by alt-Latino bands Guevara liked at the time — Maldita Vecindad, Fabulosos Cadillacs, Mano Negra — and asked: “Would you buy these records for the music alone, even though they’re not in English?”

“What I kept hearing was no, because it’s not in English and I can’t relate to it,” Guevara says. “It’s not in my culture. It’s not in my experience. It isn’t the soundtrack of my life.” — Agustin Gurza, “1999 was the year…” (LA Times, 2004)

But in 2019, that soundtrack is changing. Playlist by playlist, algorithm by algorithm. It’s what this trigger cities concept is all about.

It’s now entirely plausible that a kid in small town Nebraska, because she played “Taki Taki” a few more times than the rest of her Today’s Top Hits playlist since she liked the beat…started to get a few more Maluma tracks then playing when it was over…which then led, in the middle of a Maluma radio session, to her saving a Paloma Mami track to her streaming library, which then sets off a whole other set of algorithms that identifies her as a Latin RnB music lover.

Music finds a way, and it also asks more complex questions.

Acts like Honduras’ Menor Menor are broadening what Latin trap “looks” like, fighting colorism in the genre. Music like Brazil’s traditional Sertanejo — receiving a huge gender re-balancing by female artists like Marilla Mendonça — is now allowing itself to gain traction faster and break stereotypes, in part liberated with streaming.

By having its own channels to more organically spread its influence, these Latin artists can now grow — slowly, steadily, permanently — into the smartphones of their future fans, wherever they may be. No need for a second “Latin explosion”.

But the next question is if trigger cities can now unlock traditionally desired music markets like the States…can’t they also unlock each other?

Is gaining market share in English-speaking markets as important as it used to be? Maybe ex-US regions bypassing the #1 music market in the world is a better option for some…

…but that’s a whole other topic altogether.

Trigger Cities Mini-Series: [Part 1-Concept] [Part 2-Southeast Asia]

Do you dig data as much as we do? Keep in the loop on the music industry’s latest data gems by tuning into our podcast: Your Daily Data Dump from Chartmetric. I’d love to hear from you at jason (at) chartmetric (dot) com.

Check your public ip address online Visit Check Ip Address