_______________________

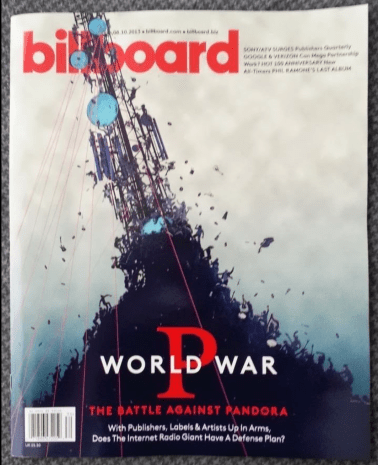

Guest post by Chris Castle of Music Tech SolutionsIn another sign that the adults may finally be in charge at Pandora, the company sold South Dakota radio station KXMZ for a reported $300,000 (after purchasing the station in 2015 for $600,000). Why did Pandora buy KXMZ (or as it came to be known, “Radio Loophole”?)At the time, which was during Pandora’s bad old days of what Billboard called “World War P”, Pandora was suing songwriters to lower royalty rates for their one product–music. According to Pandora, they were not treated fairly because terrestrial radio paid lower rates to songwriters then did they as webcasters. Apple, meet orange. Pandora’s strong move was to buy a relatively inexpensive radio station so it could try to pass itself off as a broadcaster which it clearly wasn’t. Hence, Radio Loophole.Some speculated at the time that Pandora’s board might have gotten confused that the station was in South San Francisco rather than South Dakota as it is unlikely any of them had ever been to South Dakota (and it’s almost as equally unlikely they’d ever been off the 101 in South San Francisco, for that matter).But Pandora plopped down $600,000 of the stockholder’s cash (Old Pandora’s preferred form of tender for acquisitions it seems) and then went to get the blessing of the rate court. Kind of a knucklehead move that also unnecessarily stoked the battle fires of World War P.

Related articles