Streaming Hits Important Mile Marker In 2016

While streaming's growth has certainly been noticeable in 2016, the full extent is greater than many previously thought. Indeed, recent stats show that purchase revenue barely surpased non-purchase revenue, putting streaming in a dead heat with retail and downloads.

______________________________

By Glenn Peoples of Pandora

Two new reports, one for the U.S. and one for many large music markets, provide insights into the size and direction of the music streaming market.

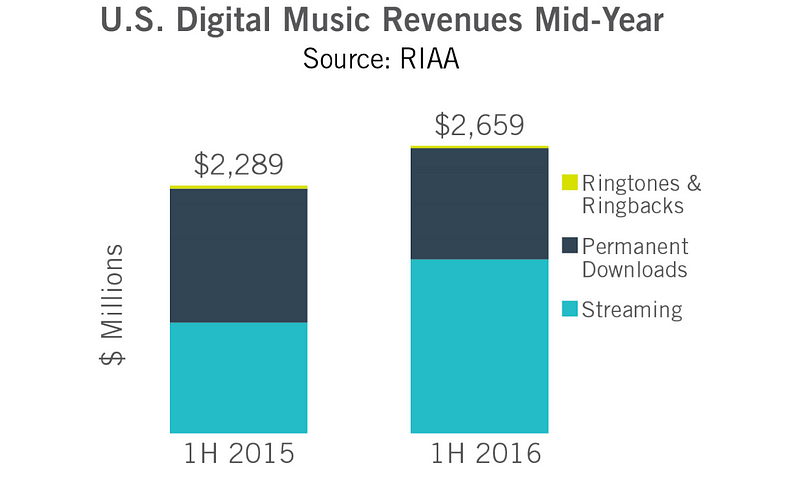

First is the RIAA’s mid-year report on the U.S. recording industry. The headline is the 8.1 percent gain in revenue. What’s most striking isn’t just the growth in streaming revenue (57.4 percent) or the decline of the download market (down 17.1 percent). The standout statistic is 50.1/49.9, the ratio of purchase revenue to non-purchase revenue. Purchases are CDs, LPs, downloads and ringtones. Non-purchases covers streaming and synchronization (just 3 percent of total revenue). It’s nearly a dead heat. The U.S. is now at the threshold of becoming a majority access market. Given the segments’ trajectories the U.S. has almost certainly surpassed the 50–50 split by now .

A few other observations. The number of subscribers to premium services doubled from 9.1 million to 18.3 million (the RIAA uses a midpoint rather than a subscriber count at the end of the period). That level of growth reflects the public’s growing acceptance of paid music services. Video streaming is way ahead—Netflix ended Q2 with 46 million U.S. subscribers, not to mention the millions of Amazon Prime viewers—but music has clearly gained serious momentum. And it only took about 15 years. In another encouraging sign, ARPU grew to $55.36 (9.23/month) from $52.59 ($8.77/month). Also worth noting is the disparity between growth in subscription revenue (112 percent) and ad-supported, on-demand revenue (24 percent).

Second is the IFPI “Music Consumer Insight Report 2016” based on a survey conducted by Ipsos Connect of Internet users in 13 of the largest markets (United States, Canada, Great Britain, France, Germany, Spain, Italy, Sweden, Australia, Japan, South Korea, Brazil and Mexico). A few findings stand out. One is 48 percent of Internet users pay for music in some form. That seems high given the recent decline in sales, but remember this survey doesn’t include people that don’t use the Internet. U.S. Internet penetration was 87.4 percent in 2014, according to the World Bank. Just for added context, Internet penetration is 86.2 percent in Germany, 84.6 in Australia, 83.8 percent in France, 76.2 percent in Spain and 57.6 percent in Brazil.

Another finding is 18 percent of all Internet users and 32 percent of 18–24(in these 13 markets) subscribes to a premium music service. Subscription rates are highest in two of the smaller markets, South Korea (41 percent) and Sweden (40 percent). The U.S. (20 percent) sits in a clump of countries with roughly the same subscription rates (Spain, Italy, Great Britain, Australia and Germany) and Japan is the lowest (7 percent).

Also worth noting is the prevalence of premium subscriptions in the 18-to-24 demo. These are digital natives that probably don’t remember the time before Napster. They’ve grown up in a world of piracy and easy access to free music. And yet they are paying for a streaming service. The music industry’s long-standing belief has been people will pay for convenience even when illegal options are available. As the report outlines, these young consumers like streaming services for their convenience, large catalogs, recommendations and security.