Television is tanking, but Radio is reinventing

The future of visual entertainment is looking bleak as TV gets more expensive, less accessible, and just plain less entertaining. Radio faces no such detriments, and continues to succeed.

Why? How?

by Fred Jacobs, President & Founder at Jacobs Media

You’ve probably noticed the differences in just the past year or so if you watch a fair amount of TV. There’s simply fewer great shows, more ads, higher fees, more subscription services, and more confusion as the television/streaming industry bubble is nearing its bursting point.

That’s the not-so-rosy view from Caleb Denison, editor at large for Digital Trends, in a detailed article, “The Golden Age of TV isn’t just over – it’s imploding,” published a few weeks ago. Suffice it to say, it’s a pessimistic piece about an industry that’s overshadowed radio since the 1950’s when TV sets started appearing in living rooms, dens, and rec rooms all over America.

His point is that the bloom is off the streaming video rose, thanks to higher fees, the appearance of ads, and an experience that’s becoming similar to cable – the main reason why many of us cut the cord in the first place.

But it gets worse, especially from the standpoint of the quality TV programming we’ve come to love these past many years: “Breaking Bad,” “Game of Thrones,” “House of Cards,” “Billions,” “Succession,” “Homeland,” and so many others captivated us and made for watercooler talk and morning show fodder.

But Denison is postulating that even with subscription fee increases along with the appearance of ads across all these video platforms, it won’t represent enough revenue to keep production budgets as stratospherically high as they were a few short years ago.

But even all this “money grabbing,” as Denison puts it, won’t change the economic pressure coming from simply more competition in this overheated space. He says that “despite all the rate hikes we’ve seen and the ad revenue coming in, it’s still not enough.”

Denison contends the pandemic was a false positive for many of these competing services. A couple years removed from the worst days of the lockdowns, most of these video platforms are now facing intense financial pressure.

Here’s how he boils it down:

“There are too many streaming services competing for viewers, and they aren’t pulling in enough viewers to make up for all the spending they did when viewership was through the roof. Economics 101 tells us that the market will only bear so much.”

So, the future of TV looks like slashed production budgets (and likelier more pedestrian shows), the consolidation of these video streaming brands and platforms, and less risk-taking.

And what of consumers? Where do they stand? On the one hand, linear TV is dying. The only people waiting for “Wheel of Fortune,” “Jeopardy,” and the local news are north of 60. The rest of us have become accustomed to the on-demand model.

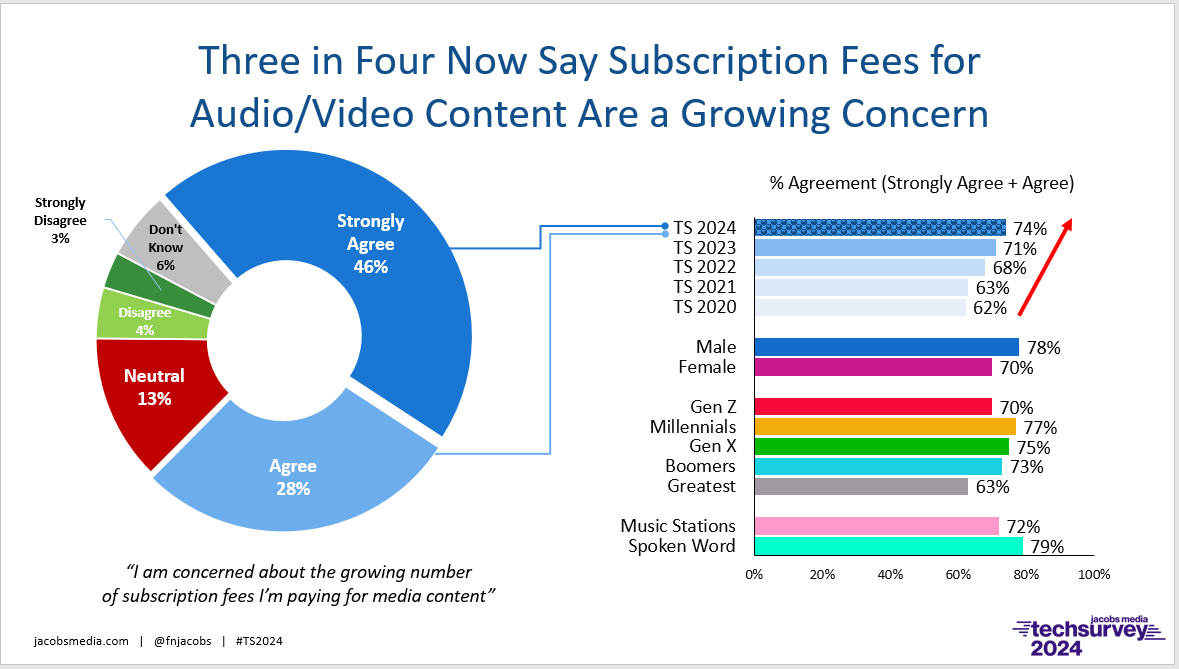

But at these prices? Brand new info from Techsurvey confirms this high level of dissatisfaction with the collective number of streaming services we’re all paying for each month. Perhaps we’ve just accepted the fact we have to pay for content, but when it now comes with commercials and the shows and movies aren’t of the same quality they were in 2019, well that’s a problem.

Look at the trending (upper right going back several years for respondents agreeing with the statement:

“I am concerned about the growing number of subscription fees I’m paying for media content”

What started as general dissatisfaction is metastasizing as each year passes, and more TV content is behind pay walls. Looking at our newest TS 2024 data, nearly three in four now express concerns about escalating subscription fees. In fact, nearly half now strongly agree these monthly content charges have become problematic. And this concern is being felt across many demographic groups.

So, where does broadcast radio fit in the overall scheme of things? As we’ve discussed in this space many times, radio’s “free” status gives the medium a decided edge – and it’s been on the rise since COVID. And while it’s true excessive commercial spot loads on the radio erode this advantage, not showing up on a credit card statement is a decided plus for broadcasters.

But the biggest difference between television and radio comes down to owning a key “location” that virtually all of us visit – usually multiple times a day:

Cars and trucks

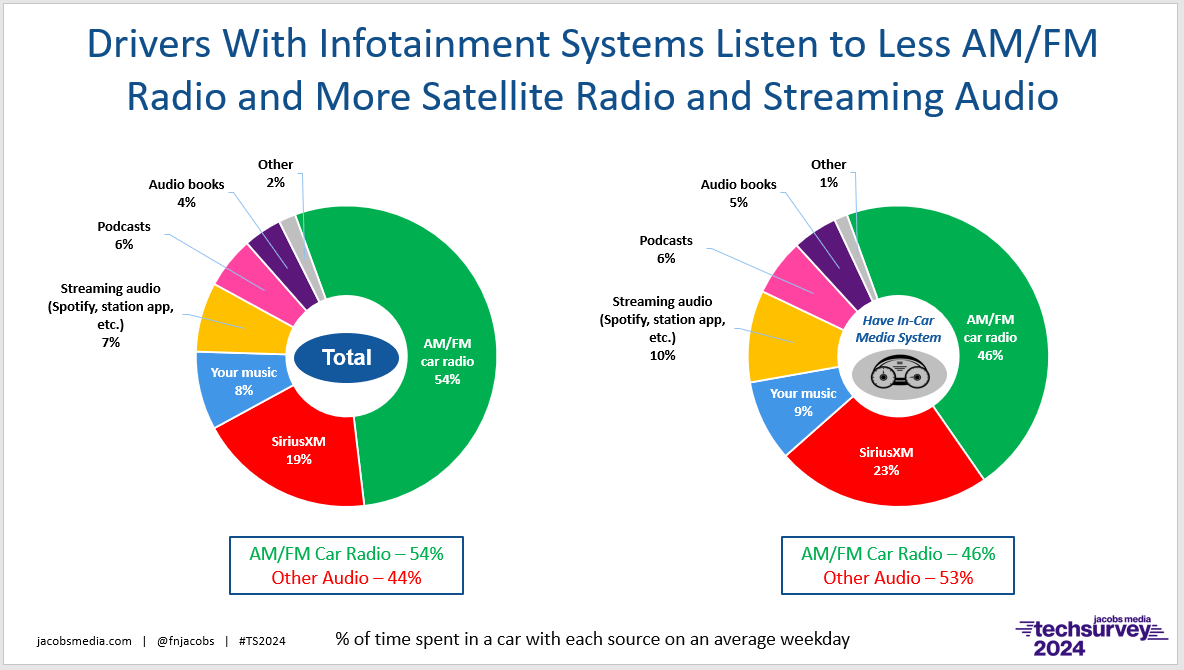

It’s about TSD – or time-spent driving, and it has decidedly worked in radio’s favor for more than 90 years. Despite increased competition in dashboards, broadcast radio’s consumption in the car puts it well ahead of satellite radio, streaming audio, podcasts, and talking books. The recently released Infinite Dial study from Edison Research confirms the notion that “radio rules” in the car. Our new Techsurvey confirms it. Among our core radio respondents (the pie chart on the left below), more than half of all audio consumption in the car is comprised of AM/FM radio stations. While that’s been gradually trending down – like a slow leak – broadcast radio content remains dominant in cars. That is, until you check out the pie chart on the right. It shows what happens when consumers buy or lease truly “connected cars.”

How common are these infotainment systems? Consider that in our new Techsurvey 2024, nearly one in three (32%) respondents drives a vehicle with a full-featured dashboard system, such as Ford SYNC or Chrysler’s UConnect. When most consumers acquire a vehicle with this type of dashboard, their listening veers away from AM/FM stations and toward satellite radio channels and audio streaming services.

And these days, virtually every vehicle rolling off assembly lines all over the world are equipped with one of these “connected” systems, even so-called “starter models.” So, on the one hand, the more of these vehicles on the road, the more pressure radio broadcasters will face from fragmented in-car listening. Sadly, Nielsen does not provide specifics about listening in cars in its biggest PPM markets, so broadcasters cannot track its most important listening location.

But there’s an odd circumstance regarding cars that is working in radio’s favor. That is, the average vehicle on the road in the U.S. is now 12.5 years-old, according to Road & Track (and many other sources). Back in the 70s, you considered yourself lucky to get five years out of an American car. Today, the reliability on most vehicles is excellent.

The longer people keep their older cars and trucks, the less choice of audio content they have. If you’re a radio broadcaster, you hope your audience keeps their cars longer and/or shops for their next vehicle on used car lots.

Every year at CES, we get to see the future of the car dashboard and in-vehicle entertainment. Besides those super-wide dashboards showing up on more and more vehicles, it’s not at all hard to spot a growing trend:

Cars and trucks are becoming mobile entertainment centers.

This year, we saw numerous vehicles touting embedded virtual meeting software such as Zoom and Microsoft Teams. We also saw an increasing number of cars with video game capabilities, including embedded games or the ability to connect smartphone games to the system.

And then there was a concept car (pictured) from BMW. A screen for the backseat drops down from the ceiling that displays 8K video content with state of the art sound. BMW talked about this feature being especially useful for those lengthy periods waiting for your EV battery to recharge. Pass the popcorn.

If you had a system with that capability at your disposal for long periods of time, are you really going to listen to the radio? As you can see on the menu screen, passengers (and the driver under some circumstances) can choose between movies, TV shows, concerts, docs, video games, or a Zoom call – all from the comfort of the back seat.

The arrival of video in cars has been a long time coming. We’ve tracked its progress in Las Vegas as screen real estate has expanded with each passing year.. For video producers, penetrating the car is a victory. For radio, it’s merely the next challenge from television – a war that’s been waged for more than 70 years now.

For the overcrowded TV and streaming industries, presence in cars and trucks could play the role of savior. Sadly for radio, it could become the next existential crisis.

Fred Jacobs founded Jacobs Media in 1983, and quickly became known for the creation of the Classic Rock radio format. Jacobs Media has consistently walked the walk in the digital space, providing insights and guidance through its well-read national Techsurveys. In 2008, jacapps was launched – a mobile apps company that has designed and built more than 1,300 apps for both the Apple and Android platforms. In 2013, the DASH Conference was created – a mashup of radio and automotive, designed to foster better understanding of the “connected car” and its impact. Along with providing the creative and intellectual direction for the company, Fred consults many of Jacobs Media’s commercial and public radio clients, in addition to media brands looking to thrive in the rapidly changing tech environment. Fred was inducted into the Radio Hall of Fame in 2018.