Reasons for abandoning frozen mechanical rates at the Copyright Royalty Board are growing [Chris Castle]

“In a recent comment, I called the Copyright Royalty Board the ‘cornucopia of chaos’ which it is at least on the mismanaged mechanical royalty rates,” writes Chris Castle.

Op-ed by Chris Castle of Music Tech Solutions

We hear from an increasing number of songwriters who are learning about what is going on in the current rate fixing movements at the Copyright Royalty Board, some for the first time. In a nutshell, the Copyright Royalty Board rate fixing is a hugely expensive process that puts generations of children through university among the participating lawyers and lobbyists. By the time the money gets through the snake, so to speak, that process results in what are, frankly, scraps delivered to the kitchen tables of songwriters at the end of the day.

The rate fixing proceeding sets the statutory rate for certain times of song uses that are mandated by the federal government. There are two main categories of statutory rates under that compulsory mechanical license: physical (sometimes called “Subpart B” rates) typically paid by record companies, and interactivestreaming (sometimes called “Subpart C” rates) typically paid by services like Spotify. (At least theoretically paid–often not judging by the size of the $424 million black box that is still just sitting under the collective’s five year plan.)

“songwriters have been crushed by the failure of streaming mechanical rates to keep pace with streaming’s cannibalization”

We all know that songwriters have been crushed by the failure of streaming mechanical rates to keep pace with streaming’s cannibalization of physical carriers. What many songwriters do not know is that one reason why their mechanical royalty income has dropped is due to an agreement among the major players to freeze the physical mechanical rates at the 2006 level of a minimum rate of $0.091 (currently worth approximately $0.06), and then to extend that freeze several more times for a total of 15 years so far. (The freeze essentially codified the controlled compositions rate but applied to all songwriters in the world.) There is a current proceeding at the Copyright Royalty Board in which the major players have reached an agreement to extend that 2006 freeze for another five years starting in 2023 and running to 2027. Shocking, I know.https://www.youtube.com/embed/SjbPi00k_ME?version=3&rel=1&showsearch=0&showinfo=1&iv_load_policy=1&fs=1&hl=en&autohide=2&wmode=transparent

In fact, the majors have now got themselves boxed into a corner on the interactive streaming rates that they are trying to increase. Why boxed? Obviously because the services are not stupid and if they see physical mechanical rates frozen when the record companies are paying, they ask why should the streaming rates increase when the services are paying? (And before you ask, this bid rigging is “legal” because everyone gets an antitrust exemption (17 USC §115(c)(1)(D). Cute.)

There is, of course, an unholy connection between statutory rates, controlled compositions clauses in record deals and mechanical royalties–see this post for the history. Let’s just say for this post that a page of history is worth a volume of logic.

The point I want to make to you in this post is that time is going by and no progress is being made in the current proceeding (styled “Phonorecords IV“) just like there’s no progress being made in the last proceeding (styled “Phonorecords III“); some people ask why these rates and appeals were not resolved in the giveaway that was part of Title I of the Music Modernization Act (aka the Harry Fox Preservation Act) which created the Mechanical Licensing Collective. If you’re going to make a major change to collectivize songwriters and vastly expand the scope of the compulsory mechanical license, shouldn’t you have gotten something for it? I’d count myself in the group that’s asking those questions so you know my bias. In a recent comment, I called the Copyright Royalty Board the “cornucopia of chaos,” which it is at least on the mismanaged mechanical royalty rates.

Inflation and Mechanicals

One thing that everyone should be able to agree on is that inflation is a major factor in determining any statutory royalty rate. This is certainly standard with the webcasting rates negotiated by SoundExchange with the same Copyright Royalty Board. It seems that if someone just asked for “indexing” the rates to inflation, the CRB just might give it. But no one is pushing on that open door except the songwriters and publishers who commented on the majors proposed settlement but who cannot afford to be part of the Phonorecords IV proceeding itself.

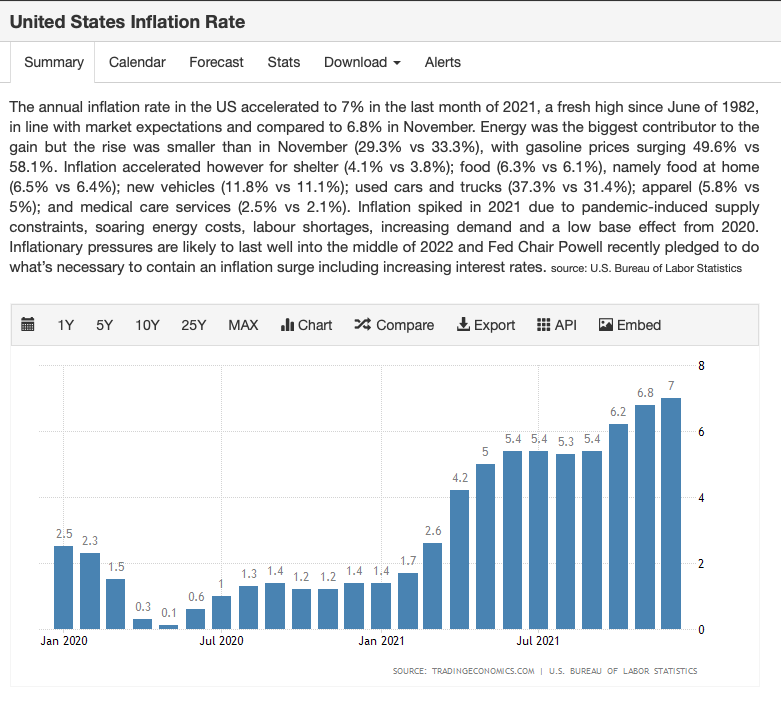

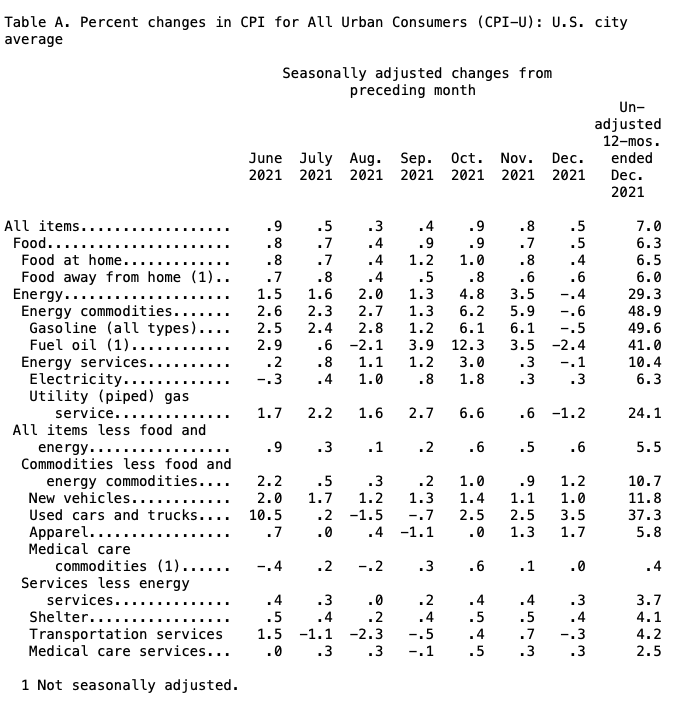

So leaving aside an increase in all of the actual rates that would reflect the value of songs, it does seem that we must accept the thinking of many economists that inflation is here to stay for a while and will surely extend into the 2023-27 rate period of Phonorecords IV. I’ve posted about these indicators before, but here’s some additional information. A cost of living adjustment seems like it should be a pro forma request–it only increases the rates if there is an actual increase in the cost of living as measured by an objective standard, typically the CPI-U (Consumer Price Index-Urban) measured by the government’s Bureau of Labor Statistics.

Since we are projecting at least two years into the future, let’s consider a few metrics that measure two years into the past. What is the trend line for inflation? Up and to the right, as they say.

US Inflation Rate

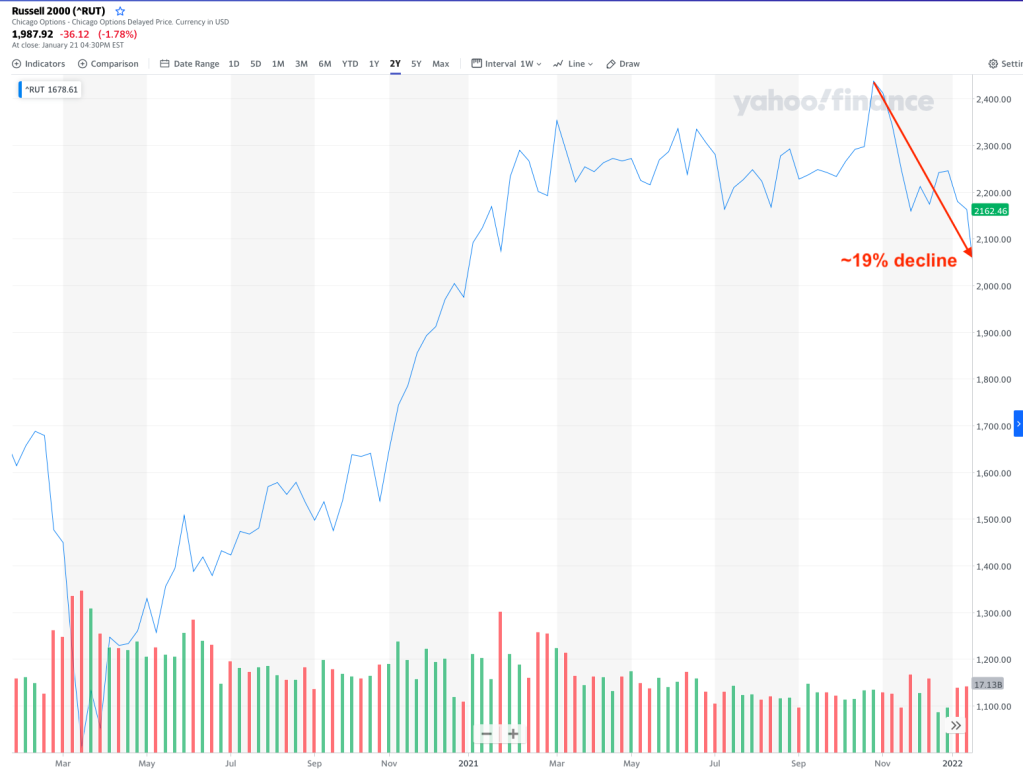

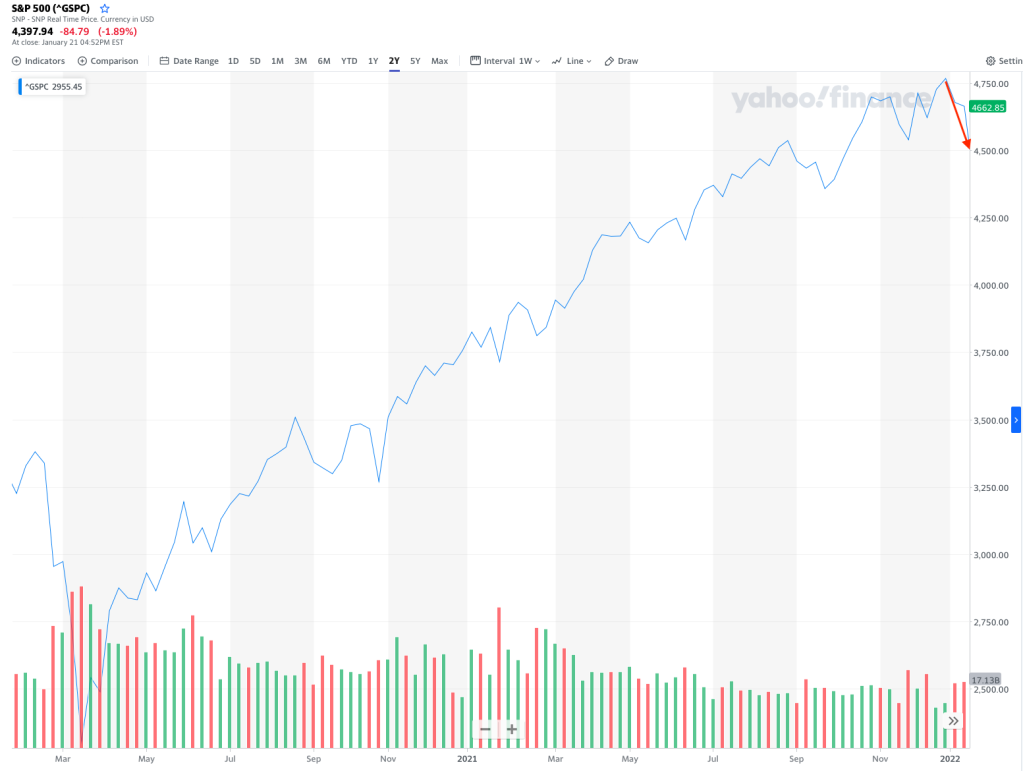

Equity Markets

We normally don’t spill much ink on the stock market because markets go up and down, can’t pick a top and can’t pick a bottom. But–stock markets are often a leading indicator of the direction of growth in the broader economy so let’s look at what’s been happening in a few different measures. Remember–the conventional wisdom is that a 20% correction to the downside is the definition of a bear market.

I have been beating the stagflation war tocsin for quite some time now (since May 2021), and unfortunately I think the markets are waking up to the true-1970s style stagflationary environment we may be entering. This means lower growth combined with surging prices for consumers and producers. And that is truely bad news bears. (If you don’t know about 1970s stagflation, take a few minutes and read up on it. And even if you don’t, the negotiators of the statutory mechanical rates really should know. Some of them may have lived through it the first time around.)

The tech-heavy NASDAQ index has dropped about 14% since November, returning to February 2021 levels with no end in sight.

The broader Russell 2000 is more revealing with a 19% decline over a few weeks as more inflation/stagflation confirmation data comes in:

This broader decline is confirmed by the S&P 500:

And if you were looking for confirmation of declining retail sales as a measure of growth, consider Amazon’s stock performance:

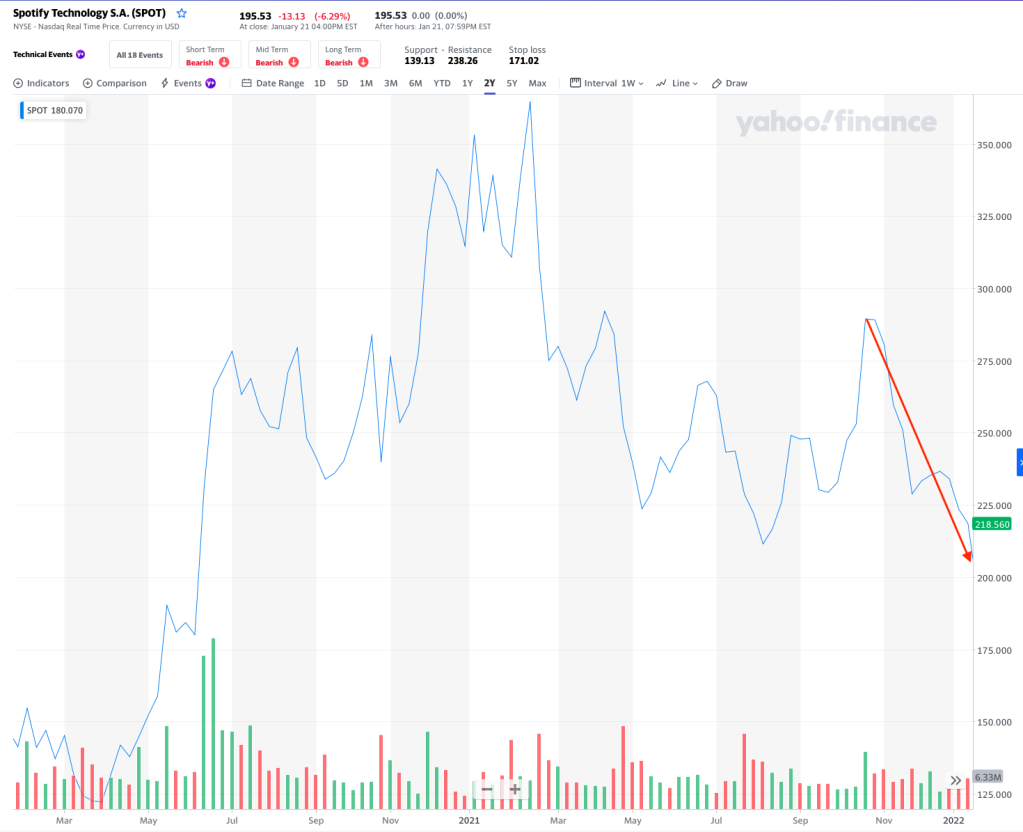

A little closer to home, consider Spotify’s recent stock performance which shows its pandemic-fueled riches coming back to reality (although not so good for any employees who got a stock option grant in the last 18 months or so):

Bond Yields

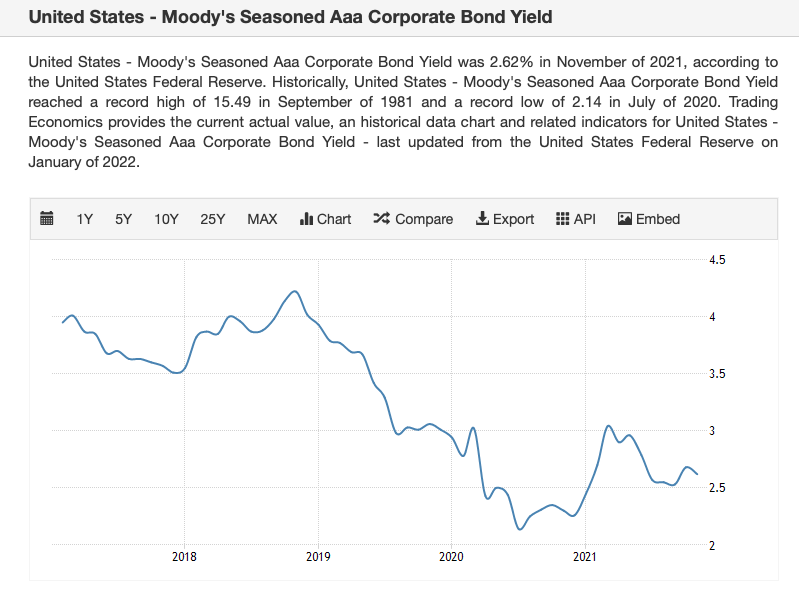

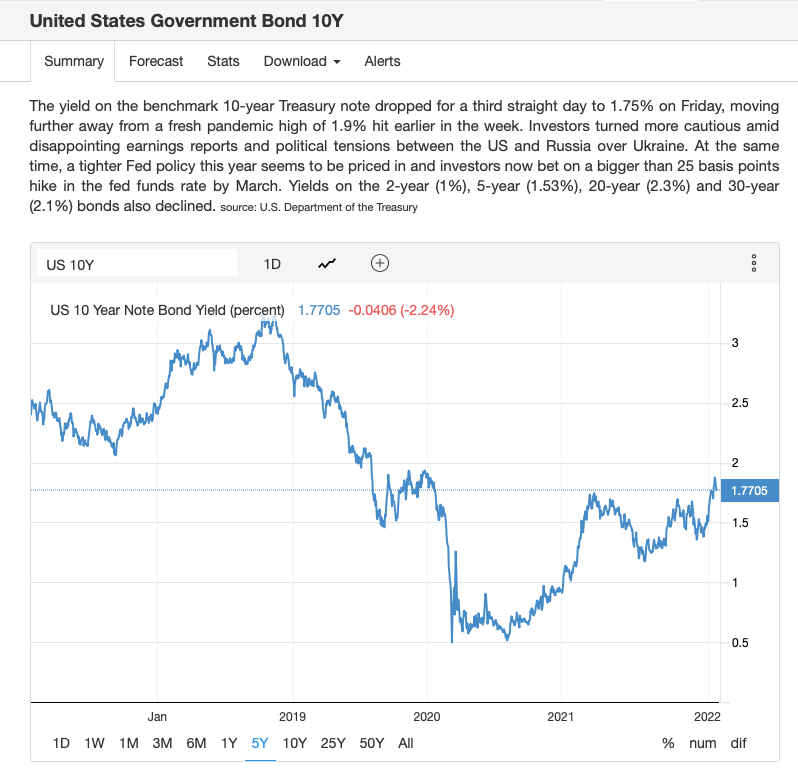

Remember, the bond market is exponentially larger than the stock market. We’ll come back to this, but consider what is happening in the bond market and think about this question: what could cause both the stock market and the bond market to decline?

US Savings Rate

The savings rate shows a couple of anomalies where the savings rate spiked to unnatural highs of 34% in a lockdown era and again to 27% after government stimulus, but–the savings rate has sharply declined to pre-pandemic 2018-ish levels Why? I would speculate that this is partly due to rising prices of goods to consumers, particularly energy, rent and food and the decline of “real” wages (nominal wages less inflation).

Commodities

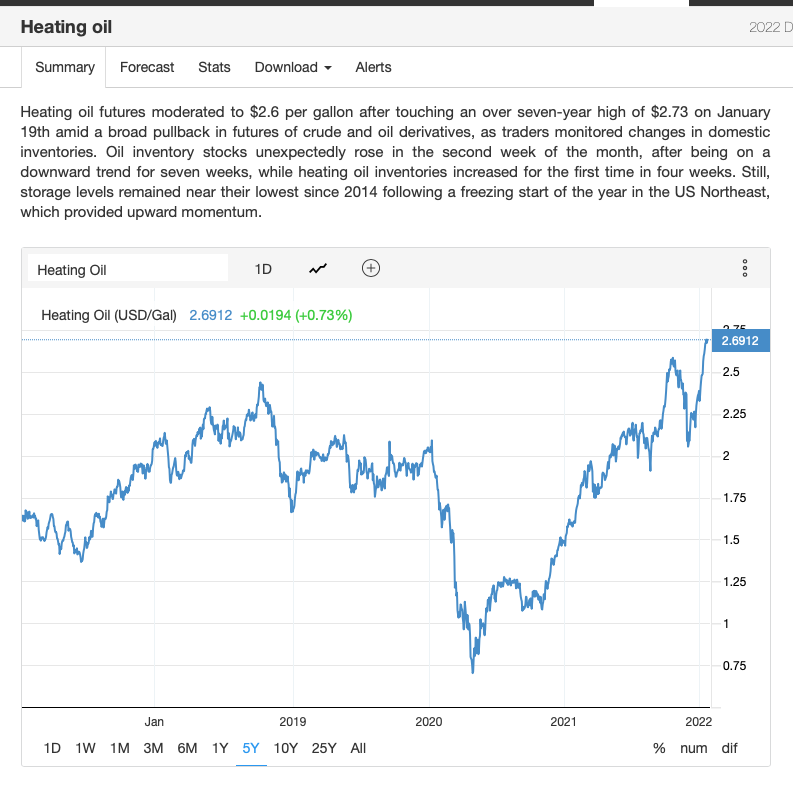

Consider a couple of inputs–there are many–but note for our purposes that these commodity prices are at or near recent highs, or are retracing recent highs. The trend line is up and to the right, which suggests that these prices are likely to continue upward into at least the first year of the Phonorecords IV rate period (2023) and potentially beyond.

Energy

However you feel about fossil fuels, the reality for singer/songwriters or bands is that the way they try to supplement their declining songwriting income is by touring and for almost everyone, touring means gasoline. I don’t have to tell you what gasoline prices are doing–you know whenever you fill up the van. This chart is a measure of gasoline futures, which is the bet that the commodity traders are making on the future price of gasoline (not the price at the pump where you live). Again, the trend line is up and to the right.

And of course if you’re going to make it to the gig or the writer room you’ll need to avoid that freezing to death thing and you’ll care about heating oil prices, up 70% year over year:

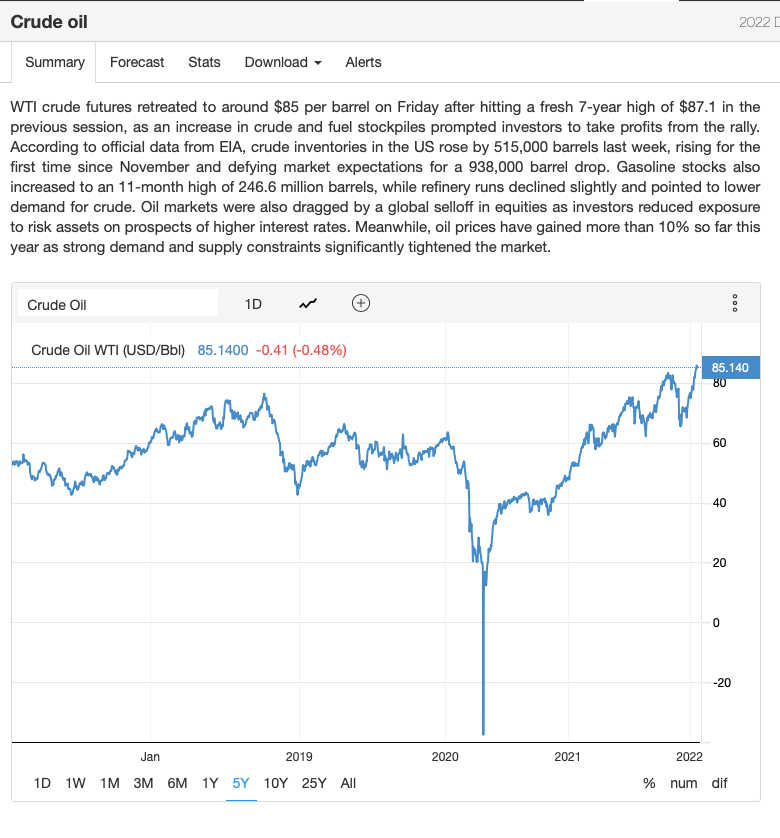

To take it a step back, crude oil is closing in on $100 a barrel due in part to exogenous supply side shocks and contractions. If crude goes over $100, we are in a whole new world that we have not seen since 2014.

Conclusion

So you get the idea, right? This is all evidence supporting a cost of living adjustment for mechanical royalties. When the stock market declines, particularly declines sharply as it is currently performing, that is largely to do an expectation of slower growth in the economy as a whole. They’ve been wrong before, but the market is actually a pretty good leading indicator of the direction of growth.

Declining stock prices foreshadow declining earnings which foreshadows declining economic growth. What happens when growth decreases? Inventories may drop, and supply declines (which is already happening and you know that if you’ve been to the grocery store lately). GDP may also decline.

Remember the stagflation three point play? In this chart, Y1 GDP declines in Y2.

Lower growth or economic stagnation is the “stag” part of stagflation.

When bond prices go down, typically interest rates are trending up, which signals an inflationary outlook. If current bond prices decline because interest rates are increasing (or are anticipated to increase), that is most likely anticipating the Federal Reserve’s announced rate increases in 2022. The number of rate increases is anticipated to be somewhere between three and five (some say even six) in 2022. The Fed increases interest rates to tamp down inflation, so you can say that lower bond prices (which vary inversely to interest rates) is anticipating the “inflation” part of 1970s-style stagflation. Just to be clear, this is all readily available public information.

It’s becoming more obvious that we are watching a slow moving train wreck (cynics like me might say we’re beginning to get hit with the balloon payment for 2008 after 15 years of quantitative easing, but that’s a story for another day). The slower the train wreck, the more likely the wreck will occur during the Phonorecords IV rate period. Since the Federal Reserve is still busily printing money, these metrics are all leading indicators of how much blood will be left on the floor starting around March 2022 or so. And we haven’t even talked about what the announced Federal Reserve rate hikes will do to the housing market even if each one is a relatively small increase.

You don’t need an expert economist to produce any original research on this for the CRB–the question for songwriters is why don’t we already have a government rate indexed to inflation? The indexed rate is only paid if you actually get an increase in the CPI, which even then only preserves the value of whatever nominal rate you do have–it’s not a “real” rate increase. So why not at least try to get a cost of living adjustment? There’s no reason not to at least try to get indexing on everystatutory rate which was the standard approach on mechanicals for many years after 1978 until the 2006 freeze. Unless your bonus is tied to a big percentage increase in the headline rate rather than the less obvious indexing that would actually protect the value of songs.

Which all seems to be to be so obvious that if you don’t have it you’d have to ask yourself, do I feel lucky? The odds are all on the house.