The state of new music discovery

In the latest example of how the industry is changing, yesterday we wrote about a new study that shows just how powerful TikTok is for music discovery.

It’s clear that the old pipeline of music discovery whereby labels would identify an artist’s ‘best’ singles and feed them to radio is eroding, but what’s next?

Guest post by Fred Jacobs of Jacobs Media Strategies

Radio and records veterans are only too aware of the basic trajectory of new music discovery. For eons, the labels have first identified artists who recorded albums and singles. The very best songs were then released and delivered to radio stations in the appropriate format. And then their promotional machines took over. Concerts, station visits, and other marketing activity ensued.

And that is primarily how hits were made. Some songs – especially by established artists were added on their day of release. Others required both the ears and courage of a program or music director, willing to go out on a limb to support a new song or an up-and-coming band.

First, it was surveying record stores and tracking requests to determine if a new song had a chance to crack through. Later, it was callout research that helped determine whether radio was on the right track – figuratively and literally.

But in recent years, the old model has developed stress cracks. Labels have less faith in radio. And most stations are no longer as adventuresome as they once were, especially at a time when the larger markets are reliant on meters to determine how many are listening.

And so, the labels have become more reliant on other methods of discovery – streaming services like Spotify, Apple Music, and Pandora, the channels that play new music on SiriusXM, songs featured in TikTok videos, and Shazam hits on new music consumers have the urge to identify.

[ALSO: Data shows TikTok is a more powerful music discovery platform than Spotify]

You’d think that with all these new music exposure elements, the music industry would have infinitely more reliable ways of making one of their projects successful. But there is much evidence to the contrary, suggesting the further they move away from radio, their marketing methods become less reliable.

Case in point: A story in Heavy Consequence by Jon Hadusek uses the “pure album sales” metric – physical + digital sales – to make the point that rock is indeed not dead yet. Aside from K-Pop phenoms BTS (at the top of the chart), the rest of the big-sellers are Rock acts:

- BTS

- Beatles

- Metallica

- Queen

- Fleetwood Mac

- Pink Floyd

- AC/DC

- Nirvana

- Foo Fighters

- Led Zeppelin

As I stared at this august list of bands that can sell albums, most are in the Classic rock department. And Hadusek reaches the same conclusion:

“(After BTS), the rest of the list is dominated by classic rock and metal bands that remain as visible and vital as ever.”

While this makes a statement about the timeless quality and resonance of music that is 30, 40, and even 50 years of age, it also says something about the ability of newer acts to break out and become the new stars of 2021.

More proof of a different kind comes from Music Business Worldwide and a story by Tim Ingham with this blaring headline:

“Over 66% of all music listening in the U.S. is now of catalog records, rather than new releases”

The previous story gives the hierarchy of albums, mostly by groups that have been around for decades. And now we learn that digital streaming – the modern way to listen to music – is dominated by catalog – i.e. older music.

Ingham reports new MRC Data shows that in the first half of this year, two-thirds (66.4%) of total consumption was, in fact, catalog (defined as having been released over 18 months after a listener presses “play.”

The trendline on this data shows a pattern. In the first six months of 2020, 63.9% of consumed music was catalog. The year before – in the pre-COVD 2019 – it was 60.8%.

Conversely, of course, consumption of new music is headed in the opposite direction.

And with a little voodoo math, Ingham extrapolates this trend out to 2030. If it holds, catalog music will reach 76% of listenership, compared to new music at a very puny 24% for that year in the not-so-distant future.

To veterans of radio and records, this trend seems downright counter-intuitive – except that it’s happening right before our very ears.

As the record companies devote less energy and resources on radio exposure of new music, the less current bands and their songs seem to be having impact – not just on our sales, but in our culture.

So, what is radio’s role in new music discovery in 2021 – and what should it be?

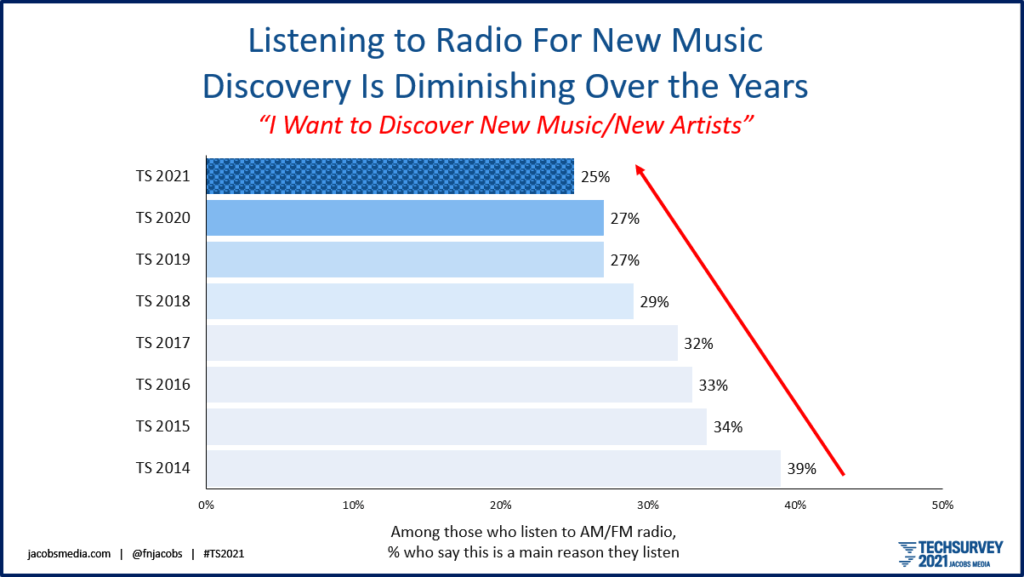

To determine how core radio listeners see it, let’s look at this year’s Techsurvey (conducted in January/February), and why core listeners still enjoy broadcast radio. We give our respondents a long list of potential attributes, and it includes “discover new music/new artists.”

This year, nearly one in four (25%) told us new music discovery is a main driver for broadcast radio listening. But the startling finding is the eight year trend:

The chart is dramatic, reinforcing the larger trend that new music appears to be having less and less impact on our culture, and it is certainly a less impactful reason for listening to radio.

But why is that?

As consumers’ listening time is fragmented across a seemingly infinite number of audio sources, there is less collective airplay of new songs and emerging artists. Radio programmers know that frequency of a song’s exposure is a key ingredient to reach mass numbers of consumers. And the more outlets that play a song, the greater the likelihood is it will become a hit.

As the Classic Rock guy, it pains me to see an opportunity for broadcast radio go untapped. But that is, in fact, the case with new music exposure on U.S. radio airwaves.

At the time Classic Rock exploded on the air and in the ratings back in the early-mid 80s, music exposure on FM radio and MTV had been dominated by new stuff: “Hot Hits,” music videos, Michael Jackson and “Flashdance.” And that is a big part of what opened the door to a format that was 100% catalog.

And so you have to wonder if a mirror image exists with radio in America in 2021. Yes, there are stations playing new music from many different format genres, but the industry’s aversion to teen consumers is so rigid, it’s hard to imagine anything especially new or innovative breaking out in a major market geared to young people.

What if there was a station that only played new music – across genres – that was all about music discovery?

Could it move the needle on selling new music rather than catalog?

Could it recharge the types of music consumers stream and listen to over the air?

Could it get ratings? And could salespeople actually sell them?

Could it influence foreign broadcasters to actually tune in American radio to see what’s going on – like they did in decades past?

Could it actually stimulate young people to listen to the radio – perhaps discovering it – in some cases – for the very first time?

Well, could it?

MORE: Data shows TikTok is a more powerful music discovery platform than Spotify

Fred Jacobs: President & Founder at Jacobs Media

Fred Jacobs founded Jacobs Media in 1983, and quickly became known for the creation of the Classic Rock radio format.

Jacobs Media has consistently walked the walk in the digital space, providing insights and guidance through its well-read national Techsurveys.

In 2008, jacapps was launched – a mobile apps company that has designed and built more than 1,300 apps for both the Apple and Android platforms. In 2013, the DASH Conference was created – a mashup of radio and automotive, designed to foster better understanding of the “connected car” and its impact.

Along with providing the creative and intellectual direction for the company, Fred consults many of Jacobs Media’s commercial and public radio clients, in addition to media brands looking to thrive in the rapidly changing tech environment.

Fred was inducted into the Radio Hall of Fame in 2018.