What’s Next? How COVID-19 Will Affect Music & Media [Mark Mulligan, MIDiA]

From musicians left without a source of income to empty movie theaters and a growing desire to cocoon, the COVID-19 crisis will have a lasting effect on consumer behavior and the music and media companies left standing.

By Mark Mulligan of MIDiA and the Music Industry blog

The spread of COVID-19, and the responses of industry and governments alike, is unprecedented. It is, however, the restrictions on movement of people along with the response of consumers and investors that is causing the biggest disruption and will have the most impact on entertainment businesses.

MIDiA has produced a report that explores the potential near- and mid-term impact of COVID-19 on entertainment businesses, from production through commercial to audience consumption. The full report is immediately available to MIDiA clients but we have also created a version of this report that we are making available to everyone free of charge to help them navigate their way through these uncertain times. Below is a high-level overview of the report’s key findings, as well as details of how to get the free report.

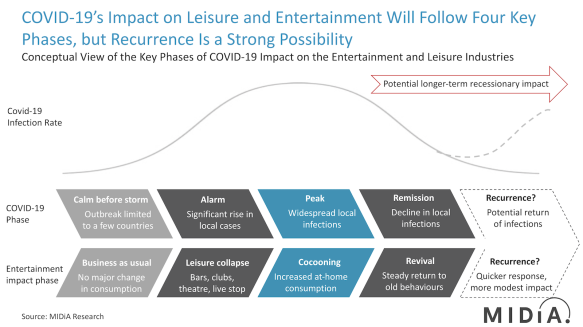

There are five phases of COVID-19 impact on leisure and entertainment: business as usual; leisure collapse; cocooning; revival; and finally, recurrence. Medical opinion is split on whether COVID-19 will return once infection rates initially diminish. However, the prospect of a return – possibly seasonal recurrences – remains a strong possibility. Audiences and investors alike may well manifest alarm and concern, albeit at lower rates. Either way, governments, along with entertainment and leisure businesses, will have to plan for dips in demand – possibly for years to come.

Production

Although entertainment – live performances excepted – is easily consumed away from public places, the production process of most content still often includes significant human contact and is therefore at risk from COVID-19. Not all media industries are equally affected, however. Restrictions and guidelines concerning groups of people and home-based working have already started to hit the filming of TV shows and movies, with many projects put on hold. Meanwhile, staples of linear TV such as soap operas (many of which have older, at-risk cast members), quiz shows, game shows and reality TV are all likely candidates to halt filming. In music, recording studios are closing down, creating a similar supply chain challenge. If the pandemic persists long enough to keep the population home-bound for months, both music and TV companies are going to start running out of new content to deliver to their audiences. Games, however, is a very different story, with many games publishers able to continue the development of games with work-from-home (WFH) workers. This is a distinct market advantage. Podcast creators and social talent are similarly well placed. In fact, independent content production as a whole is well positioned to weather this storm

Live entertainment

Consumption of entertainment in venues (encompassing sports, cinema, music, theatre, clubs) is significantly more impacted in the short term by COVID-19. However, recovery should transpire in the mid- to long-term. Sports has been particularly hard hit and was one of the first sectors to respond, initially playing games behind closed doors and then stopping leagues and events entirely. The consumption hole that sports has created (for both live and televised sports) is an opportunity for other forms of entertainment to fill. TV rights deals face the risk of re-evaluation if the shutdowns persist. Live music is another high-profile victim, as testified to by the share price tribulations of Live Nation. Live streaming of concerts is still nascent and COVID-19 may have come a little too early for the sector to truly capitalise. Nevertheless, there is already a groundswell of activity that will grow – though promoters may find themselves cut out of this new value chain. Once the pandemic is over however, live music will return to strength as the unique experience of being at a live music cannot be fully replicated digitally.

Consumption

Although the leisure industry may be facing a near-term Armageddon, entertainment is set for a boom. During the last recession consumers cocooned, allocating more time in with entertainment at home rather than spending to go out. When MIDiA asked consumers in Q4 2019 (i.e. before COVID-19 became a global pandemic) they stated they would do the same in the face of another recession, with 49% saying they would go out less. That will increase with movement restrictions. The additional time will add around another 5% to available time for entertainment, while the removal of the daily commute will add another 10% for workers. So even without considering extra time from potential unemployment and under-employment, the average working consumer has another 15% of their waking hours addressable by entertainment.

Outlook

While there are plenty of evidence-based models to predict the likely impact of a global recession, modern-day evidence for the impact of a global pandemic is scant and largely theoretical. The economic impact of the COVID-19 crisis is unchartered territory. It is however likely that those companies that have the confidence and ability to invest in growing through and beyond the pandemic will be best placed once the crisis abates.

One of the unintended consequences of the COVID-19 crisis may be a creative renaissance. In the history of artistic output, adversity often results in the most powerful creativity. Creatives from script writers, through song writers to special effects designers may find themselves inspired to craft some of the most poignant and impactful work they have ever created. We may be on the verge of golden era of song writing by established artists combining the raw emotion they felt in their youth with the learned creative professionalism that comes from being a professional artist or song writer. Indeed, the media industries as a whole may come out of the COVID-19 crisis with the most powerful creative ideas they have ever had.

However, in no way does this suggest this is a good thing for the economic plight of creators, nor does it diminish the duty of care that content companies have for their creative talent during this incredibly difficult period. Many creators will face economic hardship unlike any other that they have experienced, and there is a responsibility right across the value chain for helping struggling creatives throughout the COVID-19 pandemic. Some may even find themselves forced out of creativity all together.

To download the free MIDiA report, COVID-19 | Recessionary Impacts and Consumer Behaviour, follow this link.

Stay well and healthy.