The Inconvenient Demographic Truth Of Radio

Fred Jacobs examines the reality of radio's demographic challenge, it's addiction to the 25-54 year old age bracket, and it's need to capture the attention of Generation Z, which is already the largest generational group of them all.

_______________________________

Guest post by Fred Jacobs of Jacobs Media Strategies

Over the decades, a lot has changed in radio. The industry's technology has exploded – “software” has moved from albums to CDs to hard drives. Music is scheduled by computers, not with index cards. Air personalities routinely connect with listeners via social media sites, not just at remotes. And now, consumers can access radio stations on phones, tablets, and smart speakers. Radio time is now sold programmatically. And on-demand has become a fact of life, spurring a flurry of podcast activity.

That's a lot of change over the years, forcing radio veterans to adapt to changing technologies – new content and distribution outlets. Yet, there's one aspect of the radio broadcasting industry that hasn't changed one iota:

Radio's addiction to the 25-54 year-old demographic.

The age-old excuse – “That's what advertisers want” – has become a mantra that virtually every broadcast radio programmer faces. Bonuses are based on this target audience, research has become focused on this 30-year age span, and wins and losses are measured by where stations rank on its yardstick. For the 35 years I've been consulting stations in the “rock family” – Classic Rock, Mainstream/Active, and Alternative – in diary and later PPM markets, the 25-54 ratings are for all intents and purposes, the only demo that matters.

See the Results of Radio's Largest Online Survey

Over 500 radio stations and 64,000 listeners participated in our 2018 Techsurvey. The results reveal how radio listeners are using new technologies.

That “logical leap” to 35-64 that many have theorized about over the years has never happened, despite the fact that as Baby Boomers aged, their spending on homes, cars, medical, and travel has only accelerated. And as a result, broadcast radio surrendered its Soft AC, Smooth Jazz, and Oldies stations to SiriusXM and streaming pure-plays.

Despite it all, Classic Rock and Classic Hits have had banner ratings results these past 5 years – designated as the “formats of the summer” by Nielsen – both are on the “endangered formats” list because of their organic, unstoppable appeal to those 55+, and therefore useless to radio marketers and sellers.

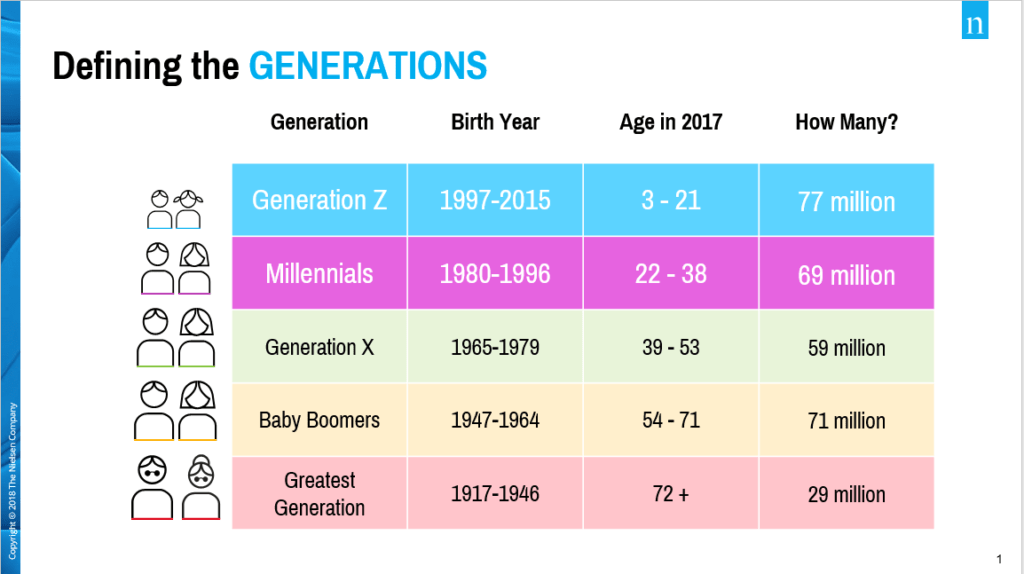

But enough about aging Boomers who are now card-carrying members of AARP. Let's take a look at their grandchildren. Here are Nielsen's latest population estimates, broken out generationally:

This powerful chart from radio's ratings company of record clearly shows just how powerful a force Millennials have become. In just the blink of an eye, they will outnumber Baby Boomers. And by the way, isn't it time to stop thinking about Millennials as “kids?” Defined as 22-38 years-old, they now sit at the base of radio's core 25-54 demographic. If your format doesn't have solid appeal to Millennials, your ability to hit Top 5 status in the most desirable demographic is strongly impeded. For years now, most radio companies have paid scant attention to these young consumers, as they first got iPods, then smartphones, and later Spotify and YouTube accounts to suit their music needs.

But let's look past Millennials to the truly remarkable, but inconvenient truth about this chart:

Generation Z

These consumers – 3-21 year-olds – are already the largest generational group of them all. At 71 million strong, they are an up and coming, formidable consumer spending force. They're a big reason why companies from many industries are already talking, planning, and brainstorming both strategies and tactics designed to win them over.

Radio for Gen Z? That oft-claimed “93% reach” number isn't even close. Many kids simply don't know what a radio is. And by the time they're old enough to drive, that SUV in the driveway will pair their phones, providing them access to media and entertainment from the Internet (or satellite) service of their choice – platforms they're comfortable with and have grown up with.

Amazon gets it. Their colorful Echo Dot for Kids product is designed to teach kids the “Alexa language.” As toddlers learn how to access content on the platform, they will become fluent in a second language – Alexa-ese making it seamless for them to make purchases and access entertainment as they grow up. It's a brilliant strategy that's future focused. Yes, Amazon is trying to make its Q4 numbers, but they're also focused on 2020, 2025, and beyond. By the way, this Amazon Echo Dot For Kids product retails for the not-so low low price of around $70- more than twice the price of the comparable Dot being marketed to the rest of us.

So what does research tell us about Gen Z and how they listen to music? To gain perspective on where music is being consumed in America, we have to go “across the pond” to check in with AudienceNet, a UK-based research company. Their new scan of media habits in the USA is a beautifully presented 35 page report containing multiple stories on every chart. They sampled 3,000 Americans with online access, ages 16+ this past July.

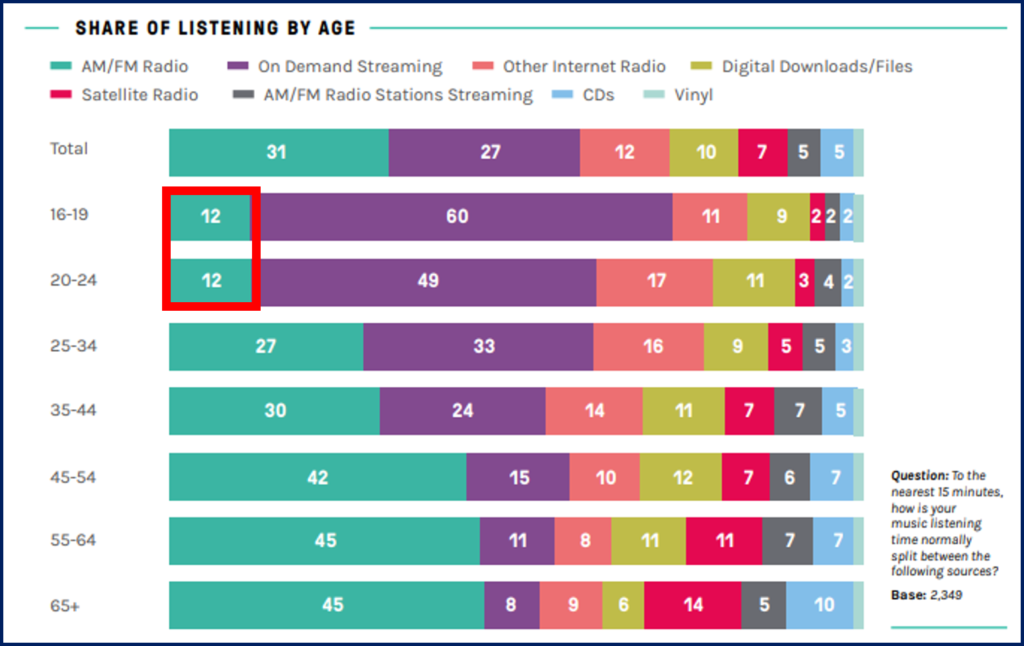

This chart shows how to visualize the box radio has put itself in largely because of its 25-54 myopia:

The 16-24 year-old demographic tells the story, where only 12% of music consumption is to AM/FM radio (note that brodcast radio streaming for music is in the single digits in every cell, not really making a big difference). And when you isolate 16-19 year-olds – a demographic that radio hasn't even thought about since the 70s – their use of on-demand streaming platforms for music is almost 5x over broadcast radio listening. The chart also indicates that even among that first 10-year group in the coveted “money demo” – 25-34s – music streaming services are now in the lead.

So what does all this portend for the future, especially as established broadcast radio formats like Classic Hits, Classic Rock, and even Country hit that “demographic cliff” at age 55?

It strongly suggests the hundreds of broadcasters talking about data, Alexa, dashboards, and podcasting here at the Radio Show in Orlando might want to devote some think time to this demographic perfect storm that's been brewing for years.

Maybe it's a good time to make some choices – either broadcast radio will finally have to justify and support stations that skew 35-64 to a stubborn ad community. Or the industry will finally have to start getting serious about appealing to Millennials, as well as their younger brothers and sisters. Radio has a serious Next Gens(s) problem that isn't going to magically resolve itself when today's teens become adults.

Public radio is at least cognizant of the problem – and actively trying to do something about researching and understanding young consumers. While they, too, are often judged by their 25-54 performance in diary and metered markets, many on the network and local levels are actively thinking about future generations and how to serve them. Studies like “The Millennial Research Project” we conducted in partnership with PRPD and a group of curious public radio stations are indicative of the thought process occurring inside public radio conference rooms as I write this blog post.

Erica Farber is running around the Radio Show, talking to her “community” of radio owners, managers, and sellers. This is her opportunity amidst hundreds of her members, to gain a better sense of their concerns and priorities. Maybe a few of us should pull her and the RAB team aside and have that inconvenient generational conversation.

Until the radio industry makes generational diversity a priority, broadcasters will continue to go their merry way, killing a format or two every few years, and mindlessly chasing a 25-54 year-old demographic no longer interested in its offerings.

Radio has a choice – find a way to make aging Baby Boomers a vital, viable, and marketable demographic. Or begin a serious focus on Generation Z, and its future.

Why not do both?

You can access the AudienceNet report here.