Pandora’s Financial Hole: How Deep Is It?

Yesterday, we got word that losses at Spotify had more than doublded, and we've known for some time that Panora has its own money woes. Chris Castle takes an opinionated look at Pandora's current financial plight, and how far it has to go in order to extricate itself from the financial hole in which it currently resides, regardless of who may be at the helm.

_________________________

Guest post by Chris Castle of Music Tech Solutions

Given the recent minority investment from Sirius and sale of Ticketfly, it appears that Pandora is now being governed by the board and not its senior management team. This should come as no surprise to anyone–the stock is down about 27% for the year, and is down a sharp 30% or so for the last three months. In fact, it was down almost 5% today alone. Some Pandora stockholders might have been asking themselves, “Where is the board?” Hello…it’s them.

It is important to recognize that despite its checkered history with minuscule payments to songwriters and artists, Pandora does write a pretty big check every year to the industry as a whole. After all the royalty rate discounts we’ve given to Pandora over the years, most of us feel like investors in the company, so we’d like to see that revenue stream continue for the benefit of the industry as a whole, and especially for collective licensing through SoundExchange and the audits it conducts.

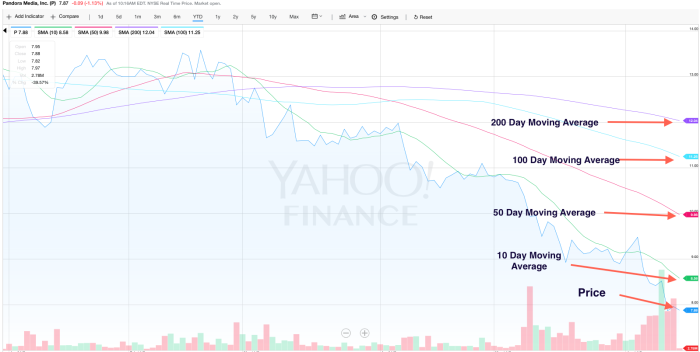

However–the most rudimentary technical analysis of Pandora’s stock shows just how far either the old or new management has to go, and this is before taking into account the dilutive effects of the Sirius investment. The company’s share price has sunk like a stone through the 200, 100, 50 and 10 day simple moving averages of its share price to close today at $7.58. Investors Business Daily’s rankings show Pandora outperformed by 91% of other stocks. A number of analysts have cut their price targets on Pandora since the Sirius investment, which may signal disappointment that there was no sale and Pandora is now stuck with the current management. We’ll see.

It’s clear that the technical signals show the company has a long, long way to go to dig out of the current ditch it was driven into. On the other hand, Pandora has just raised a ton of cash, so we hopefully will not see the company coming back to artists and songwriters hat in hand asking for yet another break on royalty rates.

But–with Sirius now holding 19% of the company on an as-if-converted basis and three board seats including the chair, I wouldn’t rule out another stab at getting the artists and songwriters to help finance Pandora’s rich overhead costs and debt service (running at approximately 48% of revenue). Those Sirius guys ain’t playing.

Barron’s reported on Sirius CEO Greg Maffei’s commentary on streaming:

One notable media executive had some harsh words for streaming music services during a speech at a Deutsche Bank investor conference [in March]. “We think it’s a very unattractive business,” said Liberty Media CEO Greg Maffei, noting the high cost of music rights. “You’ve seen that with Spotify now with 50 million users [and] still not profitable.” [emphasis mine]

Not much interest in getting the overhead down, a whole lot of interest in getting the royalties down.

So fasten your seatbelt’s kids, it’s going to be a bumpy night.

It doesn’t seem like any of the streaming companies are making any money.