Pandora Makes The Case For Building A Full Stack Streaming Music Company

Songkick's Ian Hogworth apparently coined the term, but I first heard about "full stack" music companies during a webinar that PledgeMusic and DotBlockchain co-founder Benji Rogers gave for BerkleeOnline. He was referring to the rollup of PledgeMusic, Noisetrade and Set.fm into a multi-faceted artist services company. Now, Pandora's Glenn People's makes the case that their acquisition of Ticketfly and other initiatives are creating the first full stack music streamer.

_______________________________

Building the Music Company of Tomorrow

Building the Music Company of Tomorrow

How Ticketfly Helped Pandora Create a Full-stack Music Streaming Company

By Glenn Peoples, Music Insights and Analytics at Pandora

Key takeaways:

- “Stacking” ticketing onto streaming creates a new type of music company, the full-stack streaming company, where Ticketfly gains access to Pandora’s user base of 81 million monthly listeners.

- Pandora can leverage its listening—22 billion hours in 2016—and listener data to deliver hyper-focused messages and win incremental ticket sales.

Until a few years ago, ticketing and music streaming existed in entirely separate verticals. Since the late ’00s, dozens of ticketing companies have sprouted to challenge the traditional ways venues and promoters sell and market tickets. At the same time, streaming services had changed how people listen to music, all the while growing into mainstream products with many tens of millions of listeners. Because their businesses had some overlap, ticketing and streaming companies would often partner to, say, display tour dates on streaming services. But although they undoubtedly had customers in common, these companies never officially tied the knot.

This standard relationship changed, however, in 2015 when Pandora dove headfirst into ticketing with its acquisition of Ticketfly, an eight-year-old company across the Bay from Pandora’s Oakland headquarters. Pandora’s goal with the purchase was to build a new type of music company that would improve the user experience and help artists reach fans. In doing so, this became the first, and still the only, combination of a streaming service and a ticketing company — and a music-focused ticketing company at that.

Enter the term “full-stack digital music.” A full-stack digital music company combines products that complement and add value to one another. (The term has been used by Songkick founder Ian Hogarth to describe the convergence of music streaming and ticketing. It’s a take on the term “full stack developer.”) Stacking one company atop another brings to mind the vertical integration, a combination of companies from different stages of production; think of a paper manufacturer buying a pulp mill. In the case of this digital music stack, the streaming service creates new sales by connecting listeners to concerts where they live. If not for Pandora, the listener may not have found out about a show. Further, Pandora can leverage a decade of listening data to market at a granular level.

Some early results show the full-stack potential. In the first full year after the acquisition, Ticketfly’s gross revenue grew 25 percent year-over-year to $86.6 million. As CEO Tim Westergren said during the fourth quarter earnings call on February 9th, targeted messaging is “a remarkably effective driver” of ticket sales. To his point, Pandora become the 5th-best traffic source to Ticketfly by the end of the year. In another case, Pandora and Ticketfly partnered with Riot Fest to raise awareness and drive ticket sales for its 2016 festivals in Chicago and Denver. The campaign had 23 million impressions across Pandora and Ticketfly and accounted for 12 percent of online tickets for the Chicago concert and 14 percent of sales for its sister event in Denver.

The full-stack digital music company was a sensible, perhaps inevitable, outcome of a competitive environment. In the early days of music streaming, services’ marketing to consumers often emphasized size of catalog. (First it was a few million. Then 10 million, 15 million, 20 million. Now it’s over 40 million.) With the quantity of songs being less important, services shifted their focus to personalization, recommendations and ubiquitous listening on a variety of devices. Now, larger steps are being taken. One option is a new product category. Pandora is taking this step with its launch of Pandora Premium (there will be a limited release in March). Another option for growth is an acquisition, ideally one that creates opportunities not available to either standalone company and builds a unique product. Pandora also chose this route, believing its footprint — now 81 million monthly listeners — and its listener data — favorite artists and user location, for example — would help unlock value in Ticketfly. The phrases “one plus one equals three” or “greater than the sum of its parts” are appropriate here.

Ticketing checks a number of boxes. Pandora becomes a more diversified, fuller company that can build on its 22 billion listener hours in 2016. Another benefit is Pandora can become a better place to experience music. The “discovery” aspect of music streaming can extend to live music. Listeners will be able to find concerts during the 22 hours they average each month (as of December 2016). The acquisition also gives artists another tool on the Pandora platform to help their careers. Additionally, the acquisition creates a mutually beneficial relationship. Yes, Pandora can help Ticketfly — sell tickets, attract and retain clients — but Ticketfly can also send its customers to Pandora. Complementary services are able to assist one another in this way.

Full-stack companies are actually common in the wider music industry. Take the major labels. Companies usually called “record labels” are often full-stack companies that can include publishing, merchandise, distribution, music production, live music, and in years past, manufacturing (which has since been sold off). Sound recordings have been stacked upon music publishers. Label services have been stacked on digital distributors. But until 2015, streaming services, the younger of the music companies, had been rather single-minded in approach.

Pandora believes a full-stack combination of music streaming and ticketing could provide a solution to an old, vexing problem: how to sell more tickets when many concerts don’t sell out?

One statistic is commonly used to portray the unfulfilled potential of live music: it is broadly accepted within the music industry that 40 percent of all concert tickets go unsold. The main reason? Fans never knew about the concert. Chances are the promoter, venue and/or artist did the usual advertising, promotion and social media marketing to generate awareness. A quiet, unannounced concert is extremely rare (maybe a popular band doing a secret show in a small venue). Virtually every concert is well publicized.

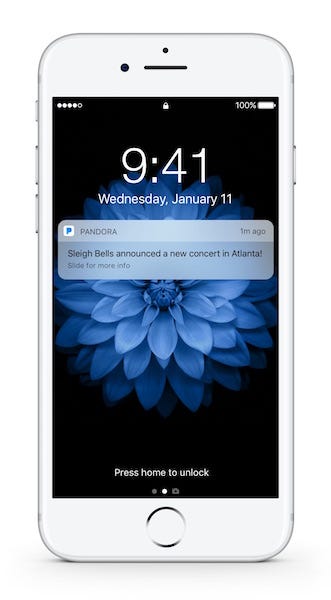

Putting ticket purchasing within Pandora should help alleviate this ongoing problem. Pandora wants to give the listener a seamless path from discovery to ticket purchase. To see the integration in action, open the Pandora app, go to the “Feed” page, and on the “Notifications” tab and find, if you can, an upcoming concert. (I get an update for an upcoming concert by electronic musician Tycho.) If it’s a Ticketfly venue, you can select the number of tickets and make a purchase after logging into Ticketfly. (Ticket-buying is not just an intra-company data issue. Concerts ticketed by another company can be marketed in the app but will not have in-app purchasing or be included in a number of other marketing initiatives, such as live-event digest emails.)

On the Ticketfly side, its clients can automate Pandora concert notifications—push notifications to mobile, in-app feed, personalized digest emails—to a targeted subset of listeners. After venues and promoters build their events on Ticketfly’s software, automatic notifications are sent to fans near the event and listeners that like that type of music. Ticketfly’s emphasis on timeliness plays to Pandora’s advantage. These notifications are sent when the show is announced and again when tickets go on sale. As a result, Pandora listeners are often the first to both know about a concert and have the opportunity to buy tickets.

Artists also have a role in promotion. Pandora’s Artist Marketing Platform, or AMP, allows artists to record brief audio messages that will stream to their fans. When a concert is created on Ticketfly, AMP will automatically prompt the artist to record a message to be heard by fans in that market. The message, concluded with a call to action, could say something like, “Hi, I’m (insert name here) and I’m playing at (insert venue here) on (insert date here). Click here to buy tickets. I’d love to see you there.”

Market research reveals the acquisition’s potential to move unsold ticket inventory. Within Pandora’s 81 million monthly listeners is a group of active music fans that counts on radio to expose them to new music and favorite artists. The average American listens to four hours of music per day and Pandora accounts for roughly 7 percent of that, according to Edison Research’s latest “Share of Ear” report. In a separate survey, Edison and Triton Digital found that 53 percent of people surveyed said keeping up to date with music is important (either “very important” or “somewhat important”). Of that group, almost half (47 percent) use Pandora to stay for staying current with music. What’s more, a significant fraction of Pandora’s listeners are the sort of active music fans that are most relevant to the Ticketfly acquisition. Over half (53 percent) of Pandora listeners are under the age of 34, a demographic filled with likely concert attendees.

Beyond the sheer quantity of listeners—potential ticket buyers, in other words—is the central role played by data. Pandora has the advantage of targeting its messages with great accuracy (see Westergren’s comment above). Pandora knows which artists a listener likes, where this listener lives, how much this person listens to what songs, artists, genres, etc. If that same listener is a Ticketfly customer, Pandora also knows something about her concert history. Does she attend many or few concerts? What types of artists headline these concerts? What are her preferred venues? This knowledge shrinks the uncertainty that’s inherent in any type of marketing. Some concert promotion is no more effective than posting concert flyers on telephone poles. Pandora’s data-driven targeting is like walking inside a record store and handing a concert flyer to a person that just bought the artist’s LP. The better approach is obvious.

The streaming business is traveling forward on a timeline. Streaming services, from early Internet radio stations to embryonic subscription services, have spent more than a decade building and refining their products into what exists today. Music streaming will undoubtedly go through more iterations and find more opportunities to deliver a better music experience. Companies will expand their footprints through acquisitions or mergers. They will take advantage of opportunities that improve their competitive standings. In all, streaming companies will update the definition of a digital music service. Pandora was a first mover in this evolution of the digital music service. It is now a streaming-and-ticketing, full-stack music company in a market where the losers will far outnumber the winners.