_____________________

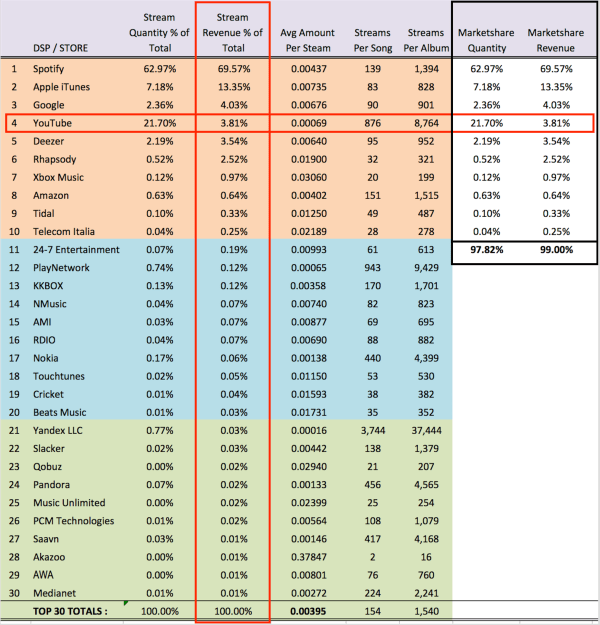

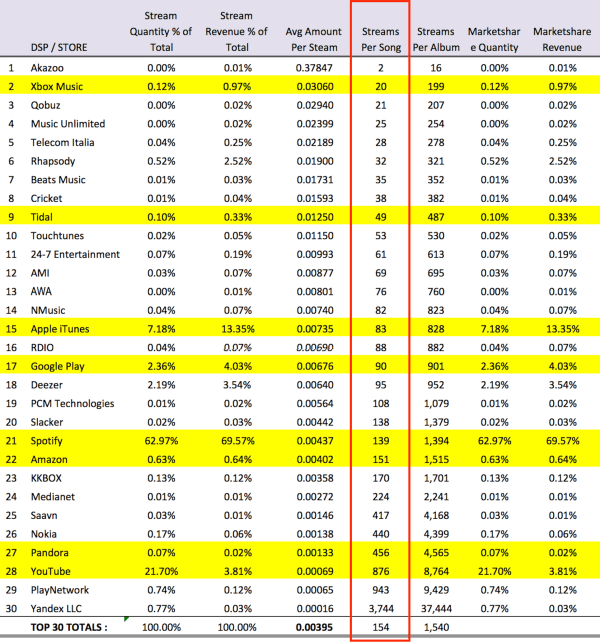

- HOW WE CALCULATED THE STREAMS PER SONG / ALBUM RATE:

- As streaming services only pay master royalties (to labels) and not publishing, the publishing has to be deducted from the master share to arrive at the comparable cost per song/album.

- $.99 Song is $.70 wholesale after 30% fee. Deduct 1 full stat mechanical at $.091 = $.609 per song.

- Multiply the above by 10x’s and you get the album equivalent of $6.09 per album

[EDITORS NOTE: All of the data above is aggregated. In all cases the total amount of revenue is divided by the total number of the streams per service (ex: $5,210 / 1,000,000 = .00521 per stream). In cases where there are multiple tiers and pricing structures (like Spotify), these are all summed together and divided to create an averaged, single rate per play.]

Related articles