_____________________________

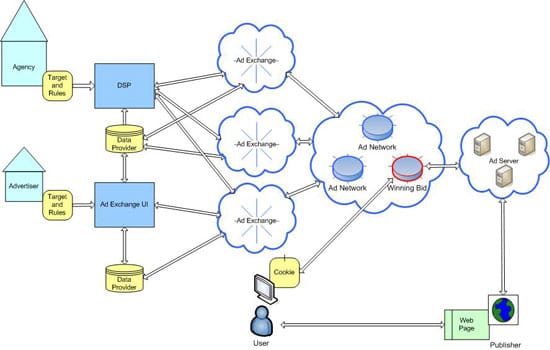

Guest post by Chris Castle of Artist Rights WatchSpotify announced today that it is selling its [actually the artist’s] fans to several different “ad tech” companies. Here’s the Spotify press release:Today we have officially enabled programmatic buying across our audio ads globally. We’re partnering with three of the largest and most established platforms in the programmatic space – AppNexus, Rubicon Project and The Trade Desk – to give buyers access to over 70 million music fans on Spotify Free.Here’s the deal: we’ve launched Private Marketplaces for our best in-class audio advertising platform on mobile, allowing access for :15 and :30 second audio spots. This makes Spotify the first publisher to enable Deal ID/PMP access across audio inventory in a true, real-time bidding environment. Buyers will also have the opportunity to access Spotify’s authenticated first party demographic data and unique playlist data.This is available globally across Spotify’s 59 markets. Buyers can target audiences by age, gender, genres and playlists – all in real time.Today’s release rounds out one of the most diverse programmatic offerings in market, now expanding across display, video and audio, with industry-leading viewability topping 95%. We’re now one step closer to our goal of making all of our innovative ad experiences available programmatically. To learn more about Audio PMPs, email programmaticsales@spotify.com.If you don’t know about “real time bidding” read this post I wrote in 2012, nothing has changed for the better from an artist’s point of view (“A New Meaning for Real Time Bidding: An artist’s guide to how the brands and ad agencies profit from advertising supported piracy“) It looks something like this: